Rising for the third consecutive month, The ISM Manufacturing Index (PMI) reached 56 in August (July registered at 54.2). While overall demand and consumption continued to increase, many survey respondents echoed that capital spending for the balance of 2020 looks to be tepid. Companies tied to aerospace, office furniture manufacturers, and those in the oil and gas markets were most likely to indicate a challenging landscape.

Registering the lowest mark in 6 years, August’s Consumer Confidence Index limped to a 84.8 mark (compared to July’s 91.7). The decrease in confidence coincides with expiration of the extra $600 weekly unemployment benefit at the end of July. With consumer spending accounting for 70% of economic activity in the U.S., the dip in confidence is a clear indicator that the economic recovery has a long way to go.

Beginning to sound like a broken record, WTI Oil Pricing stayed steady in August, trading in the low $40s. August began with a value of $41.01 per barrel, eventually reaching $42.61 per barrel. Outside of a geopolitical event to serve as a catalyst, the prevailing sentiment is for oil pricing to remain close to the current value for the balance of 2020. That said, there is optimism that prices will rise steadily in 2021 so long as effective vaccines for COVID-19 are available.

The online US Oil Rig count is at 254 which is up 3 compared to last month’s report and down 650 from August 30 of 2019. This roughly equates to a 70% drop since this time last year with these historic lows. This key and leading indicator shows the current demand for products used in drilling, completing, producing and processing of hydrocarbons which all of us use every day as fuel sources.

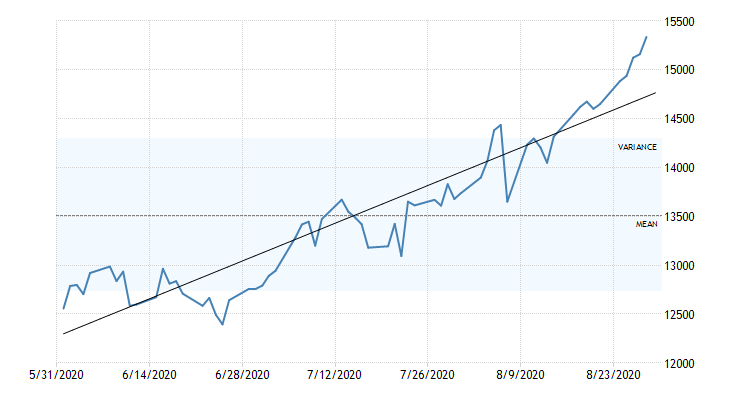

Continuing last month’s trend, Nickel kept rising in August. Starting at $6.35/lb. the commodity climbed all the way to $7.00/lb. at month end. November of 2019 is the last time Nickel was valued at this level. While the fundamentals continue to point to speculation as the driving force in the value increase, the U.S. Dollar’s declining value helps prop up metal prices in general.

The domestic steel plate mills all announced $40/ton price increases at the end of August. While it remains to be seen if the new prices will stick, the mills are hopeful that they will be able to establish a new price floor for the balance of the year.

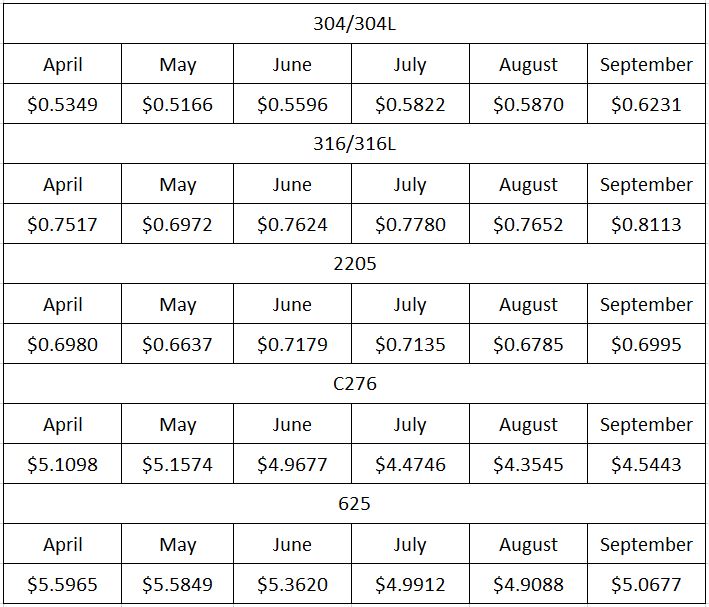

Domestic stainless mill deliveries are running from 5 to 7 weeks, while Duplex stainless mill deliveries and Nickel alloy plate deliveries are in the 7 to 9 week range. Carbon Steel plate mill deliveries register in the 5 to 10 week range.

Tubing deliveries range from 3-8 weeks for stainless steel depending upon stock availability and up to 8-14 weeks for nickel alloys. Carbon steel tubing deliveries are still carrying longer lead times anywhere from 6-16 weeks.