Slipping just a bit in July, the ISM Manufacturing Index (PMI) came in at the 59.5 mark, compared to June’s 60.6. Manufacturers continue to struggle with broad-based shortages of materials and supplies, resulting in production delays. While supply-side problems persist, survey respondents indicate that bottlenecks may have peaked or alleviated to a degree. Overall, new orders, production, employment, and backlogs are growing, while inventories are contracting.

Consumer Confidence continued to get stronger in July, registering a 17 month high of 129.1 from an adjusted 128.9 in June. Consumers’ optimism hasn’t wavered, as they expect business conditions, jobs, and personal finances to keep improving. Possible headwinds for consumers in the short term are Delta variant developments and increasing inflation.

July saw WTI Oil hover above $70 per barrel, save for a few days in the mid $60s during the middle of the month. The commodity closed at $73.95 per barrel, after starting the month at $75.23 per barrel. The short-term outlook for oil prices looks to keep the value close to $70 per barrel, with some uncertainty as to how or if the Delta variant will impact demand.

The online US Oil Rig Count is at 491 which is up 16 compared to last month’s report and up 244 from August 7 of 2020 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources.

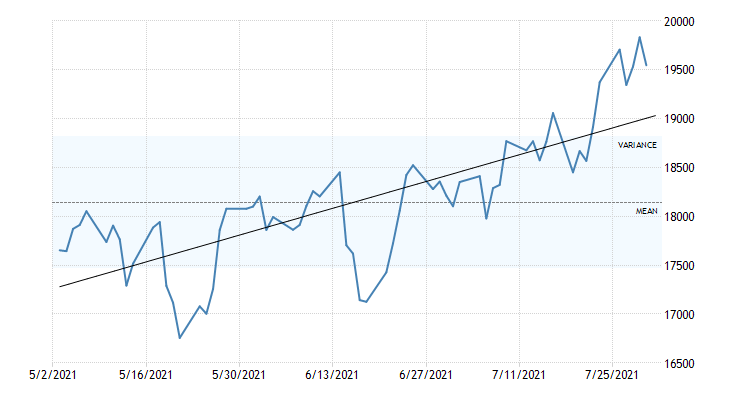

Nickel spent the month of July incrementally climbing in value, starting at $8.21/lb. and closing at $8.87/lb. Analysts are forecasting that by the end of 2021, this year will reflect a 16% demand increase over 2020. Much of that increase is buoyed by a first half year over year 36% jump in consumption of 300 series stainless. The nickel supply chain is expected to pick up the pace in 2022, likely bringing some price relief.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Continuing to defy gravity, domestic steel mills pushed another $150/ton increase into the market in July. This marks the ninth consecutive month that producing mills have implemented a price increase. There’s no indication that supply will catch up to demand anytime soon.

The USW and Allegheny Technologies finally settled their labor dispute in July. The plate, sheet, and tube supply chains have begun to work themselves towards normalcy, with the tubing sector projected to take the longest to recover. Commodity stainless and Duplex plate deliveries currently range from 7 to 9 weeks, while Nickel alloy plate deliveries are in the 10 to 12 week range. Carbon Steel plate mill deliveries continue to remain in the 8 to 12 week delivery range.

Tubing deliveries, while still lengthy, have begun to contract since our last update. Access to strip and hollows to make tubes is the key driver of availability at the present time. Some welded stainless tube offers remain at the 30 weeks or more threshold, yet many are trending closer to 27 weeks or less. Here’s the latest summary of both the welded and seamless product offerings:

Welded tubing – December’s announcement that ATI was beginning to exit the commodity stainless sheet and strip market hamstrung the welded tube market to a degree – taking capacity out of the market and putting more stress on the other two domestic stainless mills (NAS, Outokumpu) to fill the void of supply. Now that the USW strike against ATI has been settled, the supply chain impacts of the work stoppage are being addressed. Allocation and late deliveries of strip have pushed welded stainless tubing deliveries to a range from 18 to 24 weeks or more if strip is available, with deliveries of 16 to 20 weeks as the current range for nickel alloys. Carbon steel tubing deliveries remain mired in their own challenging situation, with allocation stifling the availability of raw material, pushing lead times anywhere from 10 to 18 weeks if strip is available.

Seamless tubing – Carbon and stainless seamless tubing, while costlier, has become a little more available. Current schedules now reflect 8 to 16 weeks for carbon and 9 to 17 weeks for stainless. Seamless nickel alloy tubing continues to be hampered by raw material availability as some suppliers have narrowed their quantity of stocked hollows as well as alloys in inventory. As long as hollows are available, anticipate deliveries of seamless nickel tubing in the 14 to 18 week timeframe.

There continues to be a lot of turmoil in the metal market right now so please don’t hesitate to reach out if you have any questions.

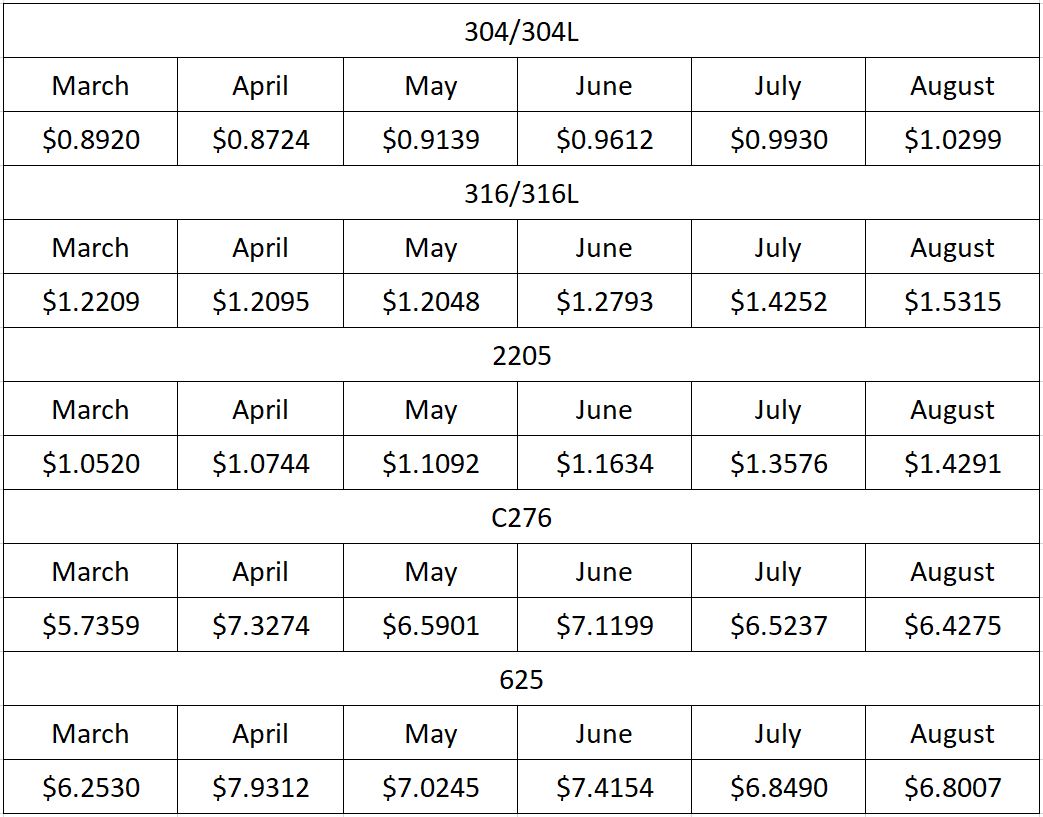

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.