Before we dive into the numbers, here’s a little lighthearted ASME Code fabricator humor for you.

Why did the pressure vessel join the gym?

It couldn’t handle the stress anymore.

Now it’s time to buckle in because we’re off to the races with the latest industrial manufacturing news and information.

The ISM Manufacturing PMI reached 48.4 percent in November, a 1.9 point increase from October’s 46.5 percent. The U.S. manufacturing sector contracted for the eighth consecutive month in November. After breaking a 16-month streak of contraction by expanding earlier this year in March of 2024, the manufacturing sector has now contracted for the last eight months. November also marks the 55th month of overall economic growth (i.e. GDP) following a brief contraction in April 2020. (Important data points reference: A Manufacturing PMI reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining. A Manufacturing PMI above 42.5 percent, over a period of time, indicates that the overall economy, or gross domestic product (GDP), is generally expanding; below 42.5 percent, it is generally declining. The distance from 50 percent or 42.5 percent is indicative of the extent of the expansion or decline.).

The Conference Board Consumer Confidence Index rose in November to 111.7 (1985=100), a 3.0-point increase from October’s 108.7.

“Consumer confidence continued to improve in November and reached the top of the range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market. Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years. Meanwhile, consumers’ expectations about future business conditions were unchanged and they were slightly less positive about future income.”

The New Orders Index moved back into expansion territory, albeit weakly, at 50.4 percent—up 3.3 points from October’s 47.1 percent.

The Production Index rose slightly to 46.8 percent in November, 0.6 points higher than October’s 46.2 percent.

Meanwhile, the Prices Index remained in expansion (or increasing) mode, at 50.3 percent, a decline of 4.5 points from October’s 54.8 percent.

The Backlog of Orders Index fell slightly to 41.8 percent, down 0.5 points from October’s 42.3 percent.

The Employment Index improved to 48.1 percent, a 3.7-point increase from October’s 44.4 percent.

The Present Situation Index, reflecting consumers’ views on current business and labor market conditions, climbed 4.8 points to 140.9.

The Expectations Index, which measures consumers’ short-term outlook on income, business, and labor market conditions, edged up by 0.4 points to 92.3, staying well above the recession-warning threshold of 80.

Preliminary results for the above were finalized as of November 18, 2024.

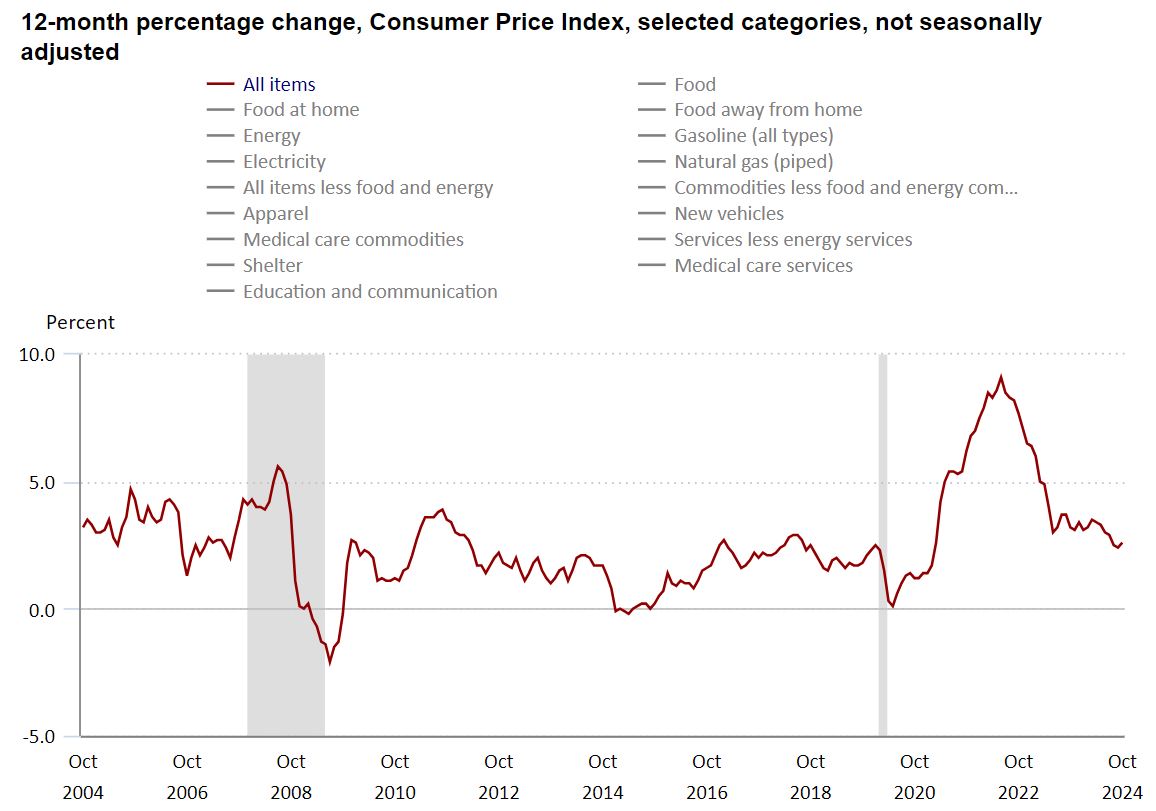

The Consumer Price Index (CPI, otherwise known as our “inflation” friend) is currently at 2.6% as of October 2024, up from 2.4% in September 2024. CPI tracks the rate of change in US inflation over time and the following shows the trends over the past 20 years.

WTI Oil continues its downward trend, entering November at $69.490 per barrel. The month’s high was seen on November 7th at $72.360 per barrel. Eight days later the month’s low was seen at $66.920 per barrel. November closed at $69.630 per barrel. The downward trend persists as OPEC+’s decision to postpone the restoration of halted production failed to boost market sentiment amid concerns about oversupply in the coming year. On Thursday, 12/05/24, the group extended the delay in increasing supply by three months, planning to implement a gradual rise starting in April and phase out production cuts over 18 months at a slower pace than initially intended. This move aligns with market expectations as OPEC+ seeks to balance falling global demand with growing output from non-OPEC+ producers. Additionally, the UAE announced a delay in its planned 300,000 bpd crude production target increase, shifting it from January to April. Despite these factors, oil is poised for modest weekly gains after last week’s significant decline.

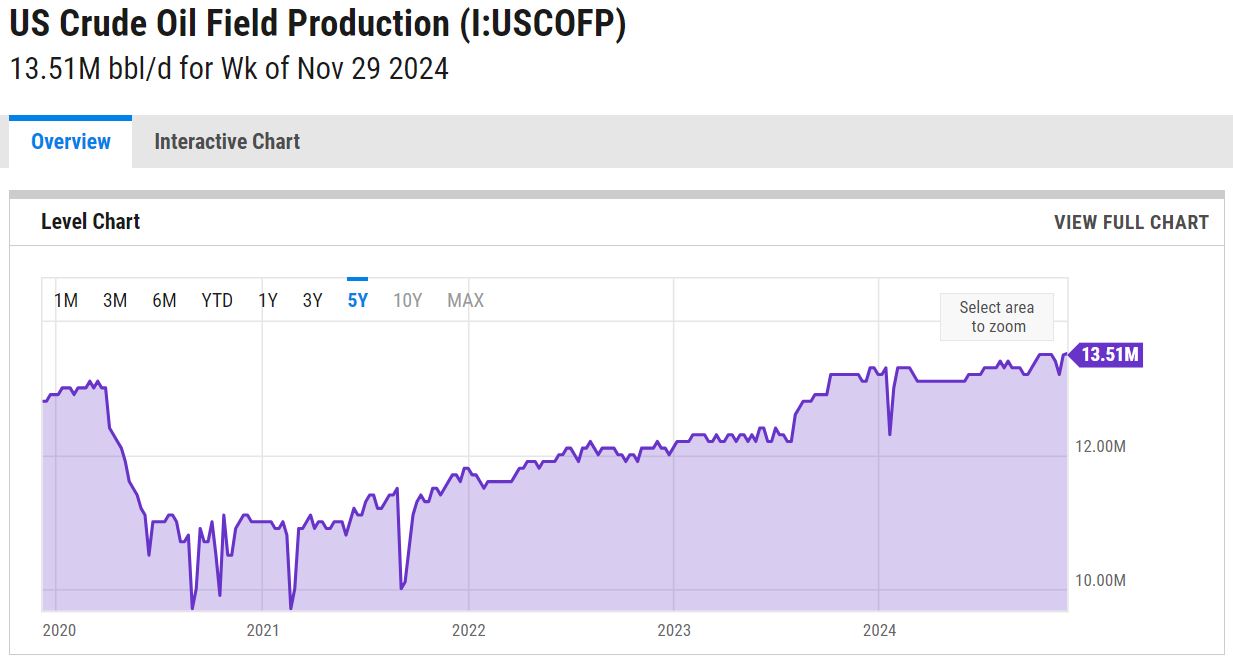

The online US Oil Rig Count is currently reported as 589 which is up 4 compared to last month’s report and down 37 from December 8 of 2023. This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing hydrocarbons which all of us use every day as fuel sources and finished products.

The number of rigs conducting oil and gas drilling in the United States continues to remain stagnant but efficiency has increased a lot over the years, as you can see from the chart below. We are now drilling at record production levels. This trend of less rigs however still reflects the priority of drillers to focus on efficiency and enhancing shareholder returns rather than expanding production through capital investments due to the current administration’s desire to move away from fossil fuels. To provide context, in 2019, 954 rigs were drilling for oil and gas in the U.S., and, in 2014, there were 1609 rigs before oil prices dropped below $20 per barrel at the end of that year.

However, solid oil prices will likely prevent the rig count from decreasing significantly, possibly leading to a rebound in 2025 with a new more oil-friendly administration taking office. Currently, the West Texas Intermediate benchmark prices have been at or around $75 per barrel, sufficient for most drillers to be profitable.

Nickel kept a tight spread throughout November. Nickel entered November at $7.250 per pound and quickly hit the month’s high on the 7th at $7.533 per pound. Nickel trended down to $7.029 per pound by the 15th then leveled out for the remainder of the month, closing at $7.262 per pound. Nickel futures bounced back to approximately $7.348 per pound after hitting a four-year low, driven by concerns over Indonesia’s tightening mining policies. As the world’s largest nickel producer, Indonesia may reduce approved mining quotas by up to 27% by 2026, according to reports. Additionally, the government is planning to lower license fees for low-grade nickel ore (below 1.5% nickel content) used in battery production, potentially limiting supply for industries such as stainless steel manufacturing. Nickel ore imports to Indonesia skyrocketed 50-fold year-on-year, surpassing 9.3 million tons between January and October 2024, as part of efforts to conserve domestic reserves. Officials, including the mining minister, have repeatedly raised alarms about depleting nickel stocks, stressing the need to prioritize domestic industries and stabilize prices.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Tariffs have tightened and will continue to tighten as the Trump administration takes office in 2025. The current White House administration announced new rules a few months ago that strengthened tariffs on metals routed through Mexico. These rules build upon former President Donald Trump’s 2018 tariffs, which imposed a 25% tax on steel imports and a 10% tax on aluminum imports.

Although Mexico was granted an exemption to the tariffs in 2019, the new rules now require companies shipping steel and aluminum from Mexico to verify their origin. Officials report that 13% of steel and 6% of aluminum imported from Mexico originate from outside North America, including China, which produces half of the world’s steel. This announcement follows the Biden administration’s decision earlier this year to raise tariffs on $18 billion of Chinese imports, targeting goods such as electric vehicles, solar panels, semiconductors, syringes, and medical gloves.

The announcement coincides with a significant increase in US-China trade over recent decades, with imports exceeding $420 billion last year—up more than 300% since the turn of the century. However, last year’s imports represented a 20% drop from 2022, as tariffs have worked to narrow the trade deficit with China.

Domestic commodity stainless plate deliveries pushed slightly, sitting in the 7 to 10 week range (was 6 to 8). Nickel alloy plates also push out slightly, seen in the 8 to 13 week range (was 7 to 12). Duplex plates tighten in lead time, updating to the 7 to 10 week range (was 7 to 12). Domestic carbon steel plate mill deliveries continue to schedule in the 5 to 8 week range. Keep in mind, some plates will exceed the estimated ranges depending on the mill’s production schedule and slab availability.

Welded tubing – Currently deliveries for domestically welded stainless tubing are in the 8 to 12 week range, leaning towards the middle of the range. For import tubes, deliveries are anywhere from 16 to 30 weeks. Carbon steel tubing deliveries have lead times ranging anywhere from 6 to 8 weeks when strip is available. Welded nickel alloy tubing ranges from 12 to 14 weeks (up to 42 weeks for imports).

Seamless tubing – Current schedules reflect 6 to 26 weeks or more for carbon steel and 8 to 26 weeks for stainless. Seamless nickel tubing is being offered at the 8 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 40 to 44 week timeframe as most hollows are of foreign melt.

Please don’t hesitate to reach out if you have any questions about the current state of our industry’s material supply chain.

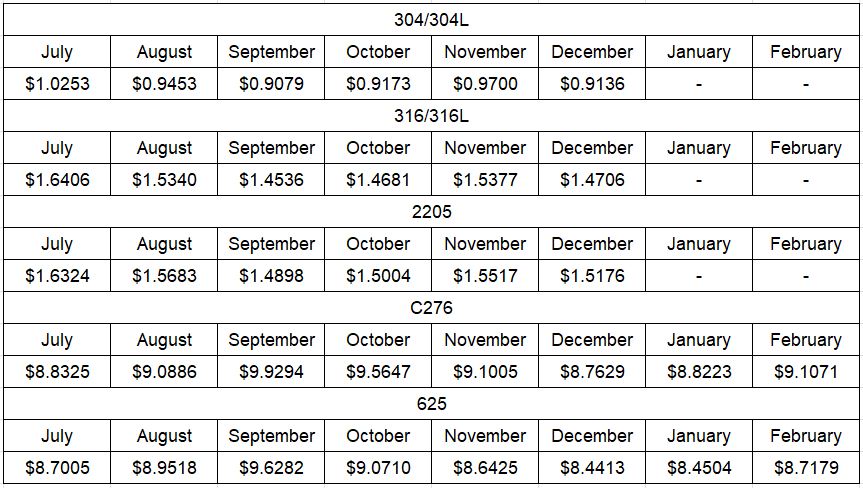

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollars per Metric ton.

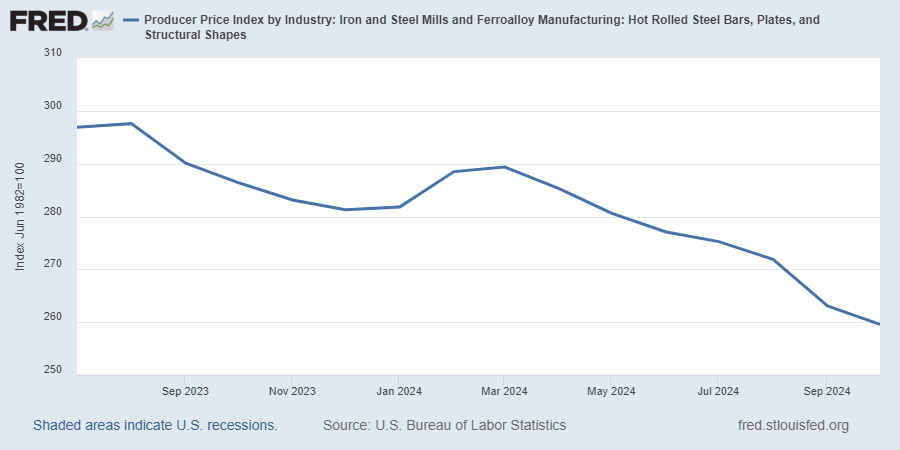

Here’s the Price Index for Hot Rolled Bars, Plate, and Structural Shapes.