The ISM Manufacturing Index (PMI) continues to reflect a robust recovery, chiming in at a 60.6 mark, a slight decrease from May’s 61.2. Overall, the manufacturing sector is struggling to keep pace with demand. Both new orders and the backlog of orders continue to increase. The flip side of that coin is that supplier deliveries keep pushing out, material prices continue to escalate, and skilled labor is in short supply. Additionally, pricing and availability in the logistics sector are proving to be a challenge.

Consumer Confidence reached a 16 month high in June, registering a 127.3 mark, up from 120 in May. Sentiment surrounding the current business climate and labor conditions recorded their best readings since March 2020. Additionally, demand for durable goods (motor vehicles & appliances) remained quite strong, suggesting sustained momentum in economic growth as we head into the 3rd quarter. The report revealed that while consumers acknowledge inflationary pressures, they are not deterred when it comes to spending money.

WTI Oil began the month of June at $67.72 per barrel, steadily climbing throughout, eventually settling at $73.47 per barrel to close. The rollout of COVID-19 vaccines, easing of lockdown policies and production cuts from OPEC (along with other oil producing nations) have contributed to the rise in oil prices. Conventional wisdom points to demand staying strong during the second half of 2021, making it look more like $70 per barrel will be the price floor for the short to medium term.

The online US Oil Rig Count is at 475 which is up 18 compared to last month’s report and up 212 from July 3 of 2020 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing and processing of hydrocarbons which all of us use every day as fuel sources.

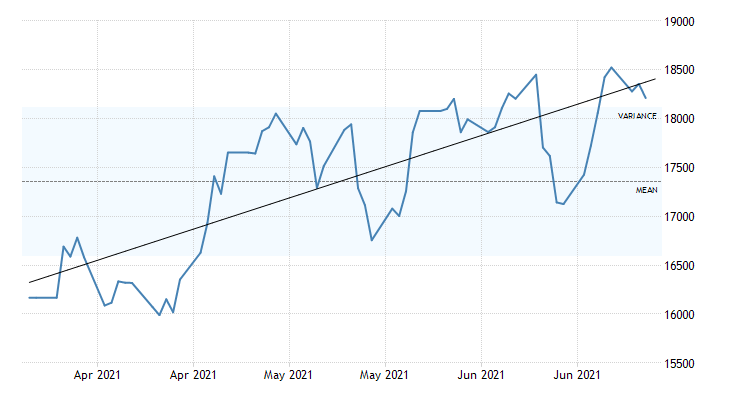

June saw Nickel trade above the $8.00/lb. level (for the most part), ranging from $8.21/lb. to start the month, to $8.26/lb. at the end. The United Steel Workers Union strike at the Vale Inco nickel mine in Canada has entered into its second month. In addition to the labor strife mentioned, demand for electric vehicles and stainless steel continues to keep pace with supply – ensuring that the price level should stay near or above $8.00/lb. for some time.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Domestic steel mills were at it yet again in June, escalating the price level to near historic highs, levying a $100/ton increase. This marks the eighth consecutive month that producing mills have implemented a price increase. As long as demand continues to outpace supply, the environment will continue to support higher material costs.

The USW and Allegheny Technologies (ATI) reached a tentative agreement on July 2nd to end their stalemate. If ratified, the new agreement will cover March 2021 to the end of February 2025. Even with this nugget of good news, the plate, sheet, and tube supply chains remain unchanged, which is to say that they are still greatly hampered. Congestion on the supply side should gradually improve once we get into the fall months. New Castle Stainless is offering commodity stainless and Duplex deliveries from 7 to 9 weeks, while Special Metals nickel alloy plate deliveries are in the 17 to 20 week range. Carbon Steel plate mill deliveries continue to remain in the 8 to 10 week delivery range.

Tubing deliveries continue to be problematic. While the news about ATI and the USW reaching an agreement is certainly welcome, access to strip and hollows to make tubes is the key driver of availability at the present time. Welded stainless tubes are still being quoted in the 14 to 30 week range. That said, here’s the latest summary of both the welded and seamless product offerings:

Welded tubing – December’s announcement that ATI was beginning to exit the commodity stainless sheet and strip market hamstrung the welded tube market to a degree – taking capacity out of the market and putting more stress on the other two domestic stainless mills (NAS, Outokumpu) to fill the void of supply. Allocation and late deliveries of strip have pushed welded stainless tubing deliveries to a range from 14 to 18 weeks, or even more if the strip is not available (i.e. up to 30 weeks), with deliveries of 16 to 20 weeks as the current range for nickel alloys. Carbon steel tubing deliveries remain mired in their own challenging situation, with allocation stifling the availability of raw material, pushing lead times anywhere from 9 to 16 weeks if strip is available.

Seamless tubing – Carbon and stainless seamless tubing have regained some of their delivery advantages. Current schedules reflect 8 to 16 weeks for carbon and 8 to 16 weeks for stainless. Seamless nickel alloy tubing continues to be hampered by raw material availability as some suppliers have narrowed their quantity of stocked hollows as well as alloys in inventory. As long as hollows are available, anticipate deliveries of seamless nickel tubing in the 14 to 16 week timeframe.

There continues to be a lot of turmoil in the metal market right now so please don’t hesitate to reach out if you have any questions.

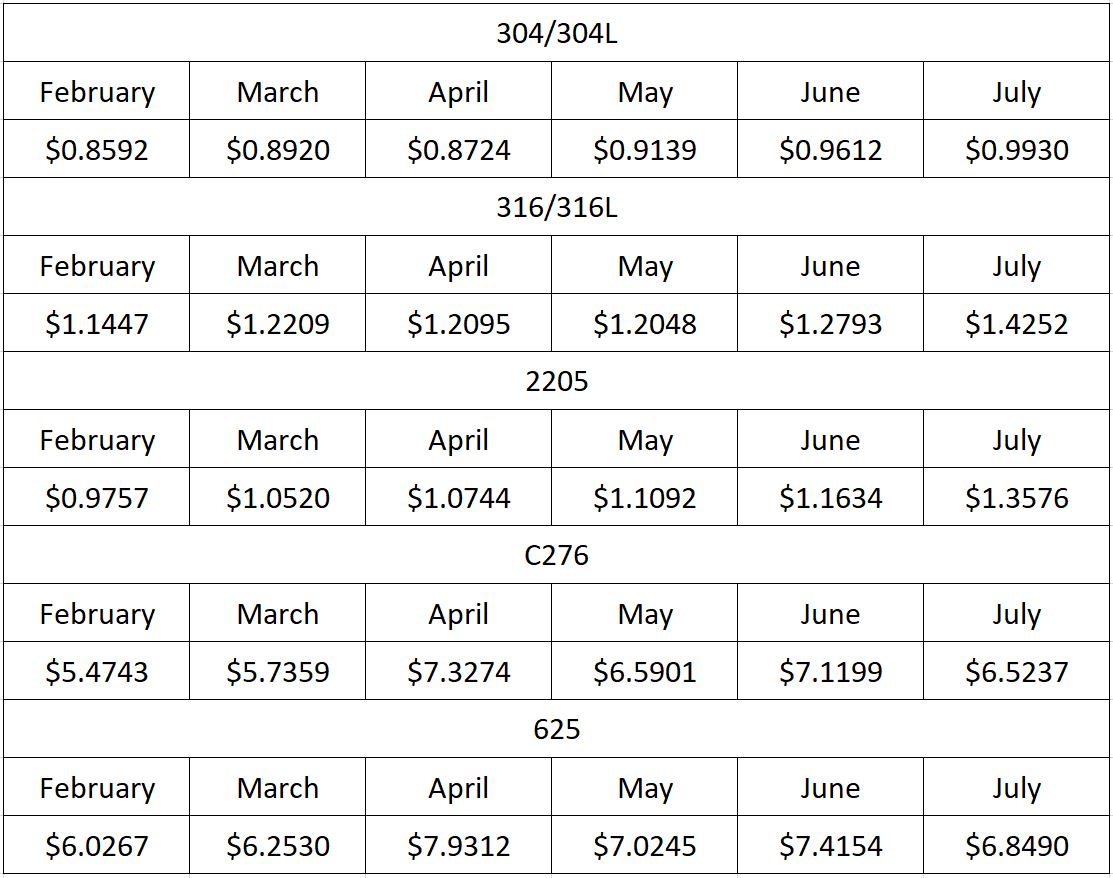

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276 and 625.