*** Emergency Update on Nickel Pricing ***

There has been a tremendous amount of volatility in the commodity market over the past two days with Nickel pricing. The London Metal Exchange (LME) has suspended trading today on Nickel after it hit record highs over fear, not driven by supply and demand.

We have heard from most of our Suppliers that all quote validity has been suspended at this point and many have stopped taking orders until things normalize. We will keep you informed as things develop and please don’t hesitate to reach out if you have any questions.

Below is a communication that we received from one of the highest volume stainless mill in the U.S. (North American Stainless – NAS).

From North American Stainless (NAS):

To all, as a result of the historic rise of Nickel, we are electing to pause the acceptance of new production orders for several days. This significant jump could cause an overreaction and we want to allow all to gain more knowledge of the circumstances and not feel pressure to make any kneejerk reactions.

Market:

Commentary: We find ourselves speechless this morning as we see what nickel prices did overnight — hitting $100,000 at one point before falling back to around $80,000. By then, the LME had seen enough as well and decided to close the market altogether, calling conditions “unprecedented”. According to Bloomberg, a Chinese spec/producer built up a massive short position in nickel and could not sustain it as prices ran higher. Bloomberg identifies him as Xiang Guangda – an individual who apparently has a controlling stake in Tsingshan Holdings and is known as “Big Shot” in Chinese commodity circles (an apt description for the trade as well). The position reportedly has been partially closed out, but is thought to be somewhere around 100,000 tons, which is massive. Bloomberg reports that it could even be larger than that after positions from “intermediaries” are also factored in.

The broker on the account is a unit of a state-owned China Construction Bank and apparently has been given more time to make hundreds of millions of dollars in margin calls. As of now, Bloomberg notes that there is “…no indication that the loss would impact Tsingshan’s ability to operate” but we have to suspect a hit of this size will crimp the company’s cash flow for some time and raise questions about its ability to ramp up output as aggressively as it was planning to.

For its part, the size of the move was so large, that the LME gave the broker more time to make margin calls. But by Tuesday morning, the LME suspended trading in nickel altogether in what could be a multi-day closure and said that some trades could be subject to reversal or adjustment. It also agreed to defer delivery obligations for its remaining contracts. We suspect the exchange will now consider a mechanism to put circuit breakers in place, a common feature in US.

February’s ISM Manufacturing Index (PMI) improved slightly from January’s 57.6 mark to register a 58.6 reading. Receding omicron cases and the rolling back of government restrictions related to the pandemic have provided an economic boost, although material shortages and inflation continue to restrain top end growth. Survey respondents indicated strong demand so long as you can navigate persistent labor challenges and supply hurdles.

February’s Consumer Confidence reading continued a gradual downward slope, declining to 110.5 from January’s 111.1 mark. While consumers recognize the significance of inflation, their opinions of short-term growth remain quite positive. In fact, they’re fairly neutral at present time, conceding that the economy may not pick up much from here, but also stating that they do not see it deteriorating either.

WTI Oil remained at an elevated level in February, starting the month at $88.20/barrel, then catapulting over $100/barrel momentarily before settling at $95.72 per barrel. The oil market, already plagued by low inventories, limited capacity, and low investment – now faces the disrupting force of Russia’s geopolitical aggression. The international community has acted swiftly to punish this move, likely keeping oil above the $100/barrel mark until the conflict is resolved.

The online US Oil Rig Count is at 650 which is up 37 compared to last month’s report and up 247 from March 5 of 2021 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

Nickel reached values not seen in a decade in February, methodically moving from $10.33/lb. at the start of the month to close at $10.99/lb. Multiple factors helped to propel the commodity, from low inventories in warehouses, to healthy EV market demand, and lastly, the developments with Russia invading Ukraine. For context, Russia accounted for roughly 5% of global nickel output in 2021. Please refer to above section entitled “Emergency Update on Nickel Pricing” for latest news.

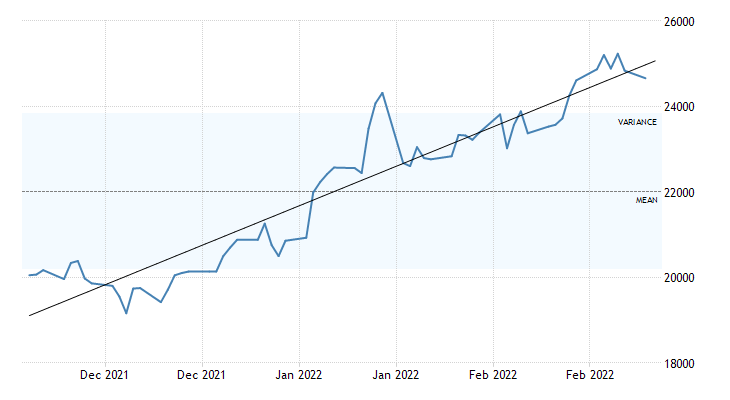

Below is the 90 day Nickel Price Trend (US$ per tonne).

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollar per Metric ton.

Domestic steel mills continued to hold steady in February, maintaining plate prices at their December level. Indications continue to point to carbon steel prices being under downward pressure as 2022 progresses.

Commodity stainless and Duplex plate deliveries remain in the 7 to 11 week range, while Nickel alloy plates are out to the 20 to 26 week range. The nickel alloy plate delivery schedules continue to be impacted by the ongoing labor strike at Special Metals in Huntington, WV in addition to increased demand. Carbon Steel plate mill deliveries continue to remain in the 8 to 12 week delivery range.

Welded tubing – Stainless strip supply has somewhat plateaued, allowing for some deliveries in the 10 to 16 week range, although larger quantity orders are in the window of 18 to 26 weeks. Carbon steel tubing deliveries have lead times ranging anywhere from 8 to 12 to 20 weeks when strip is available. Welded nickel alloy tubing ranges from 16 to 26 weeks, with some cases of 30 week deliveries.

Seamless tubing – Current schedules reflect 8 to 22 weeks or more for carbon steel (26 to 30 weeks for Western European carbon seamless) and 8 to 30 weeks for stainless. Seamless nickel tubing is being offered at the 10 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 20 to 32 week timeframe.

The metal market is still in a tremendous state of uncertainty and price volatility, so please don’t hesitate to reach out if you have any questions.

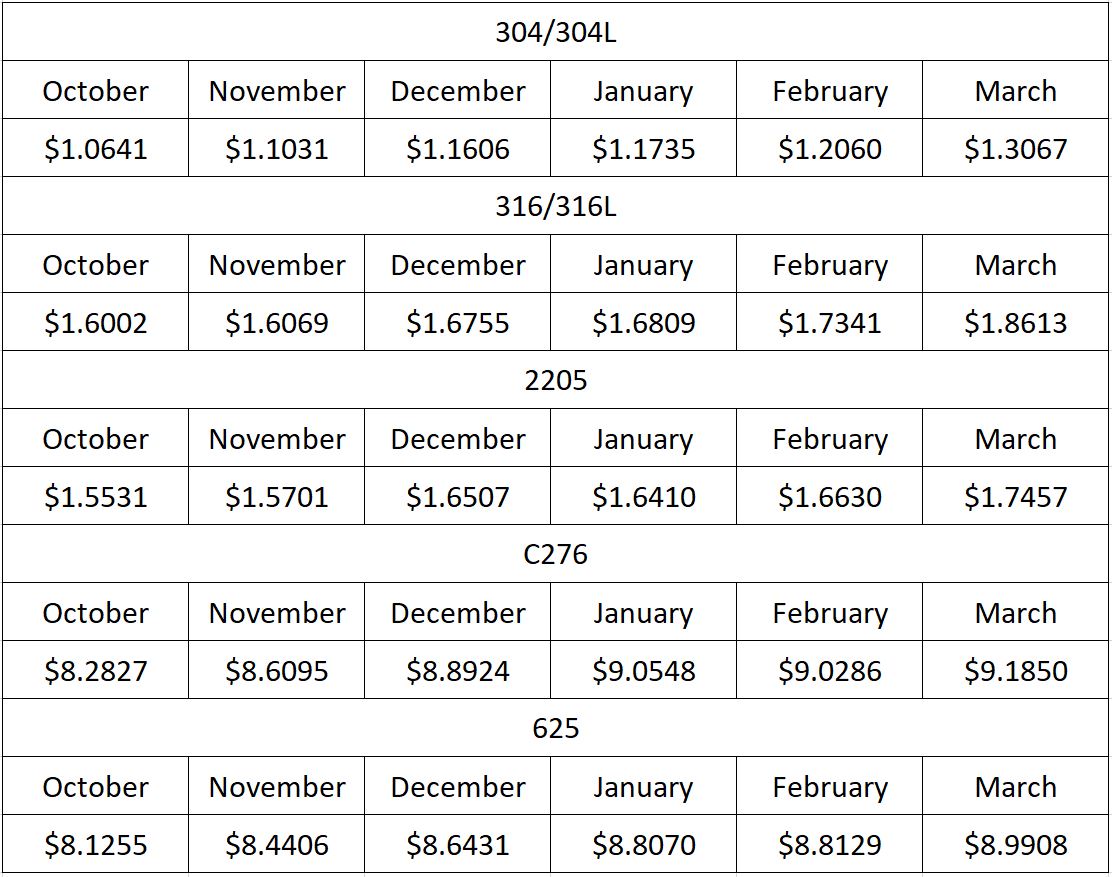

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

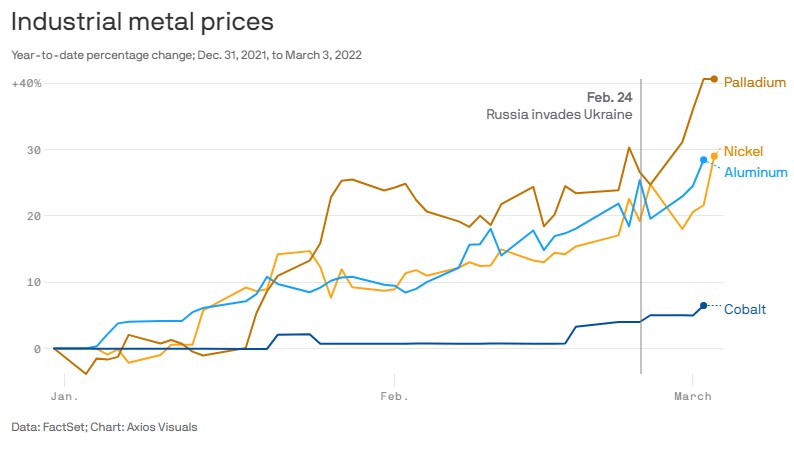

Industrial Metal Pricing – Year to Date Change Due War in Ukraine.