The ISM Manufacturing Index (PMI) increased to 47.1 in April 2023. This is a welcomed change as it rose from its three-year low of 46.3 seen in March. These figures still suggest economic activity in the manufacturing sector shrank for the sixth consecutive month after a 30-month period of expansion (above 50 suggests growth). Employment levels grew to 50.2 after two months of decline. It was seen through the survey, there were shorter lead times across the board.

The Conference Board Consumer Confidence Index fell in April to 101.3, down from 104.2 in March. The Present Situation Index, consumers’ assessment of current business and labor market conditions, increased to 151.1 from 148.9 last month. The Expectations Index, consumers’ short-term outlook for income, business, and labor market conditions, fell to 68.1 from 74.0 with 80 being the level associated with a recession occurring within the next year. The bank failures in the United States occurred about 3 weeks prior to the start of the survey which could have affected the results.

WTI Oil entered April at $80.44 per barrel. Prices peaked at $83.090 per barrel by April 12th. We then saw oil slowly fall for the remaining of the month until it closed out April at $76.780 per barrel. A surprise contraction in Chinese manufacturing activity caused by weakening global demand clouded the outlook for the world’s top crude importer. On the opposite end, Russian crude shipment jumped to over 4 million barrels a day last week despite the country’s pledge to reduce production.

The online US Oil Rig Count is at 748 which is down 7 compared to last month’s report and up 43 from May 6 of 2022 (a high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator show the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

Nickel entered April at $10.514 per pound. Prices quickly hit their monthly low at $10.203 per pound by April 5th. By the 18th, prices had climbed to $11.609 per pound. Nickel landed at $10.982 per pound by the end of the month. Indonesian output grew by almost 50% from a year earlier to 1.58 million tons in 2022, accounting for nearly 50% of the worldwide supply and pushing the global nickel market into surplus last year. On the demand side, worries about a demand-sapping recession continued to keep investors on edge despite China’s reopening and the ramp-up in production at several processing companies.

Below is the 90 day Nickel Price Trend (US$ per tonne).

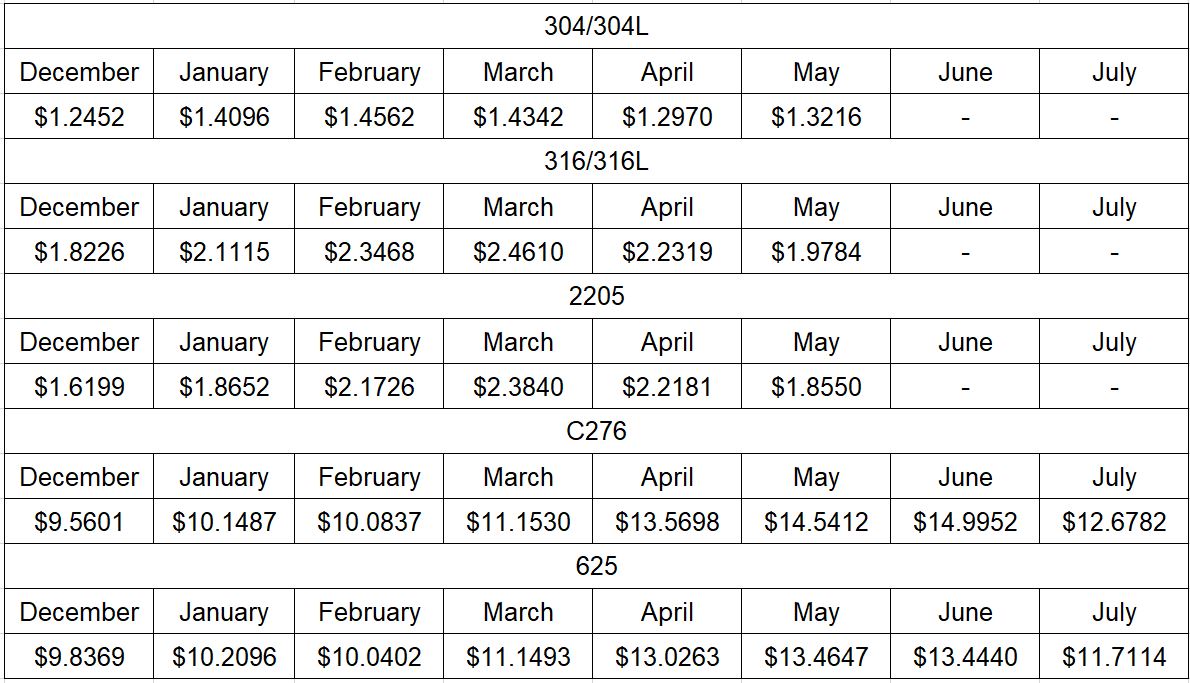

Molybdenum, a metal mainly used as an alloying agent in stainless steel, has reached highs not seen since 2008. At the end of April, pricing fell slightly but remained 23.94% higher than seen at the beginning of 2023. This decrease has directly affected the surcharges for materials containing molybdenum. Stainless surcharges will decrease once again for May, getting us closer to figures seen in January.

Commodity stainless and duplex plate deliveries pushed slightly to a 14 to 16 week range, along with Nickel Alloy plates pushing to a 13 to 15 week range. Carbon steel plate mill deliveries continue to reside in the 6 to 10 week delivery range. Keep in mind some duplex and nickel alloy plates will exceed the estimated ranges depending on the mill’s schedule.

Welded tubing – Currently deliveries for welded stainless tubing are in the 11 to 15 week range, whether small or large quantities. Carbon steel tubing deliveries have lead times ranging anywhere from 9 to 15 weeks when strip is available. Welded nickel alloy tubing ranges from 18 to 24 weeks.

Seamless tubing – Current schedules reflect 10 to 20 weeks or more for carbon steel (24 to 26 weeks for Western European carbon seamless) and 8 to 30 weeks for stainless. Seamless nickel tubing is being offered at the 8 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 20 to 32 week timeframe.

Please don’t hesitate to reach out if you have any questions about the current state of our industry’s material supply chain.

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollars per Metric ton.

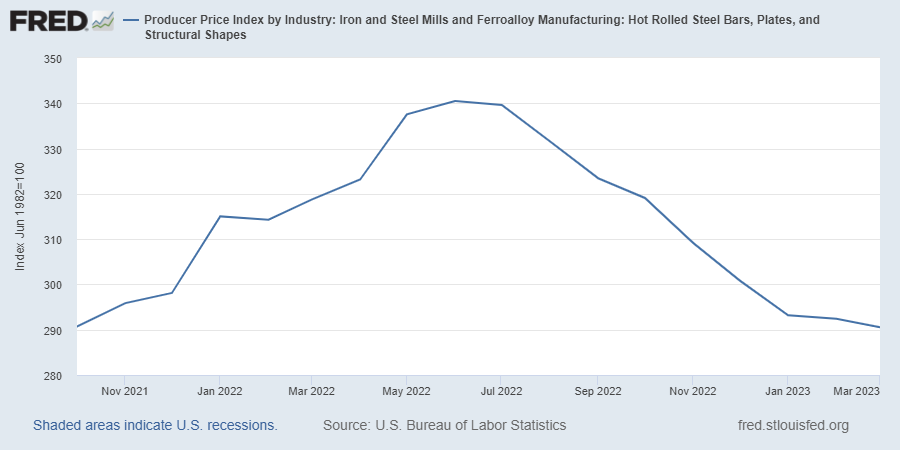

Here’s the Price Index for Hot Rolled Bars, Plate, and Structural Shapes.