Before we dive into the numbers, here’s a little lighthearted ASME Code fabricator humor for you.

Why did the welder bring a ladder to work?

Because he heard the job required a higher level of welding.

Now it’s time to buckle in because we’re off to the races with the latest industrial manufacturing news and information.

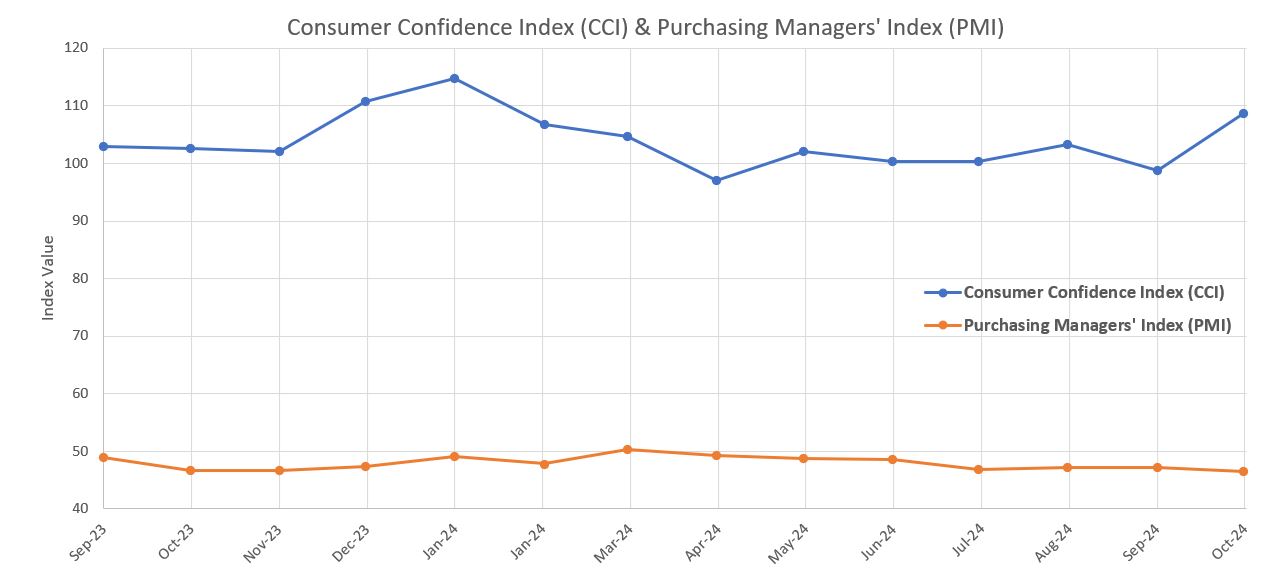

The Manufacturing Purchasing Managers’ Index (PMI) recorded 46.5 percent in October, down 0.7 percentage points from September’s 47.2 percent, marking the lowest level in 2024. Despite this decline, the overall economy has been expanding for 54 consecutive months, following a brief contraction in April 2020. (Typically, a Manufacturing PMI® above 42.5 percent over time suggests economic growth.)

The Conference Board Consumer Confidence Index rose in October to 108.7 (1985=100), up from September’s 98.7.

The Present Situation Index, which reflects consumers’ views on current business and labor market conditions, climbed by 14.2 points to reach 138.0.

Meanwhile, the Expectations Index, measuring consumers’ short-term outlook on income, business, and labor market conditions, increased by 6.3 points to 89.1—well above the level of 80 that typically indicates a potential recession.

The New Orders Index remained in contraction, at 47.1 percent, an increase of 1 percentage point from September’s 46.1 percent.

The Production Index dropped to 46.2 percent in October, 3.6 percentage points below the September level of 49.8 percent.

The Prices Index returned to growth at 54.8 percent, rising 6.5 percentage points from September’s 48.3 percent.

The Backlog of Orders Index decreased to 42.3 percent, 1.8 percentage points lower than September’s 44.1 percent, while the Employment Index increased slightly to 44.4 percent, up 0.5 percentage points from September’s 43.9 percent.

Preliminary data was collected through October 23, 2024.

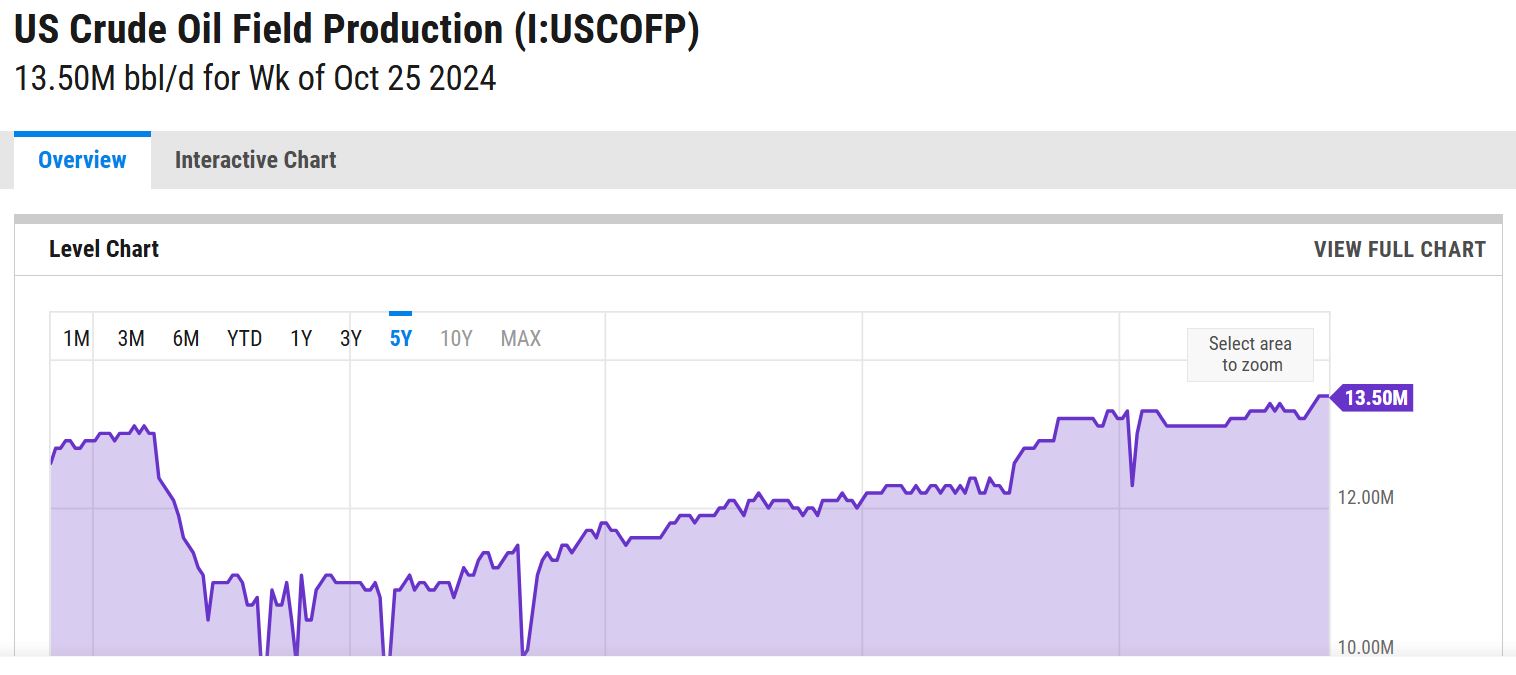

WTI Oil entered October at $69.830 per barrel. It trended upward, hitting the monthly high of $77.140 per barrel on October 7th. Prices then began to trend down, hitting $67.210 per barrel on October 29th. Pricing closed the month of October at $69.260 per barrel. The recent increase is attributed to market expectations of a possible reaction from Tehran following Israel’s latest retaliatory strikes. Investor sentiment remains cautious, especially after Israel’s military chief warned of a “very hard” response to any future missile attacks from Iran. The ongoing Iran-Israel conflict, involving airstrikes and counterstrikes, is linked to the broader unrest in Gaza. Iran, a major OPEC member, produced approximately 4 million barrels per day (bpd) in 2023 and is expected to export around 1.5 million bpd in 2024. The US has called on Lebanon to initiate a unilateral ceasefire with Israel to reduce tensions, while Israel has intensified its airstrikes in southern Beirut. Additionally, oil prices are supported by speculation that OPEC+ may delay its planned production increase in December amid concerns over weak demand and rising supply.

The online US Oil Rig Count is at 585 which is up 0 compared to last month’s report and down 33 from November 3 of 2023. This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing hydrocarbons which all of us use every day as fuel sources and finished products.

The number of rigs conducting oil and gas drilling in the United States continues to remain stagnant but efficiency has increased a lot over the years, as you can see from the chart below. This trend reflects the priority of drillers to focus on enhancing shareholder returns rather than expanding production coupled with the current administration’s desire to move away from fossil fuels. To provide context, in 2019, 954 rigs were drilling for oil and gas in the U.S., and, in 2014, there were 1609 rigs before oil prices dropped below $20 per barrel at the end of that year.

However, solid oil prices will likely prevent the rig count from decreasing significantly and may even lead to a rebound in 2025. Currently, the West Texas Intermediate benchmark prices have been at or around $75 per barrel, sufficient for most drillers to be profitable.

Nickel entered October at $8.028 per pound, then quickly hit the month’s high of $8.265 per pound on October 2nd. The remainder of the month saw pricing trend downward, closing at $7.136 per pound. Nickel prices have fallen to a six-week low, with analysts indicating that surplus market conditions and the recent discovery of nickel at Papua New Guinea’s Wedei prospect will likely keep downward pressure on prices. The Australian Office of the Chief Economist (AOCE) reports that recent production cuts have been insufficient to boost prices and anticipates weak demand will keep nickel prices subdued for the rest of 2024. Growing inventories are also underscoring the oversupply issue, with stockpiles at major exchanges up 90% since the start of the year, as production increases in China and Indonesia outpace demand. Meanwhile, Indonesia, the world’s top nickel producer, aims to balance nickel ore supply and demand to help support prices, according to its mining minister.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Tariffs have tightened. The White House announced new rules a few months ago that strengthened tariffs on metals routed through Mexico. These rules build upon former President Donald Trump’s 2018 tariffs, which imposed a 25% tax on steel imports and a 10% tax on aluminum imports.

Although Mexico was granted an exemption to the tariffs in 2019, the new rules now require companies shipping steel and aluminum from Mexico to verify their origin. Officials report that 13% of steel and 6% of aluminum imported from Mexico originate from outside North America, including China, which produces half of the world’s steel. This announcement follows the Biden administration’s decision earlier this year to raise tariffs on $18 billion of Chinese imports, targeting goods such as electric vehicles, solar panels, semiconductors, syringes, and medical gloves.

The announcement coincides with a significant increase in US-China trade over recent decades, with imports exceeding $420 billion last year—up more than 300% since the turn of the century. However, last year’s imports represented a 20% drop from 2022, as tariffs have worked to narrow the trade deficit with China.

Domestic commodity stainless plate deliveries remain unchanged since last month in the 6 to 8 week range. Nickel alloy plates hold at the 7 to 12 week range. Duplex plates remain unchanged in the 7 to 12 week range. Domestic carbon steel plate mill deliveries continue to schedule in the 5 to 8 week range. Keep in mind, some plates will exceed the estimated ranges depending on the mill’s production schedule and slab availability. The port strikes seemed to end as quickly as they started. We can now breathe easy until January 15, 2025 when the port labor contract expires.

Welded tubing – Currently deliveries for domestically welded stainless tubing are in the 8 to 12 week range, leaning towards the middle of the range. For import tubes, deliveries are anywhere from 16 to 30 weeks. Carbon steel tubing deliveries have lead times ranging anywhere from 6 to 8 weeks when strip is available. Welded nickel alloy tubing ranges from 12 to 14 weeks (up to 42 weeks for imports).

Seamless tubing – Current schedules reflect 6 to 26 weeks or more for carbon steel and 8 to 26 weeks for stainless. Seamless nickel tubing is being offered at the 8 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 40 to 44 week timeframe as most hollows are of foreign melt.

Please don’t hesitate to reach out if you have any questions about the current state of our industry’s material supply chain.

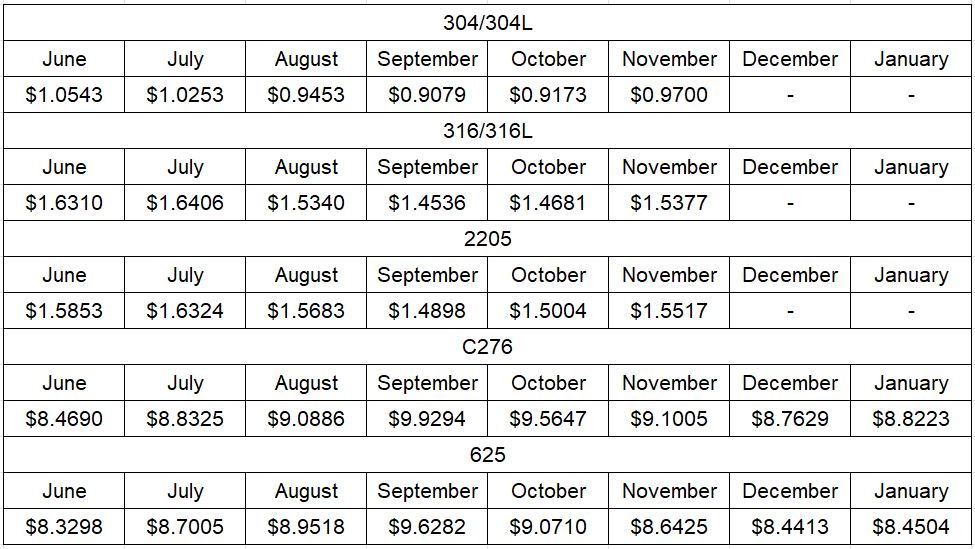

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollars per Metric ton.

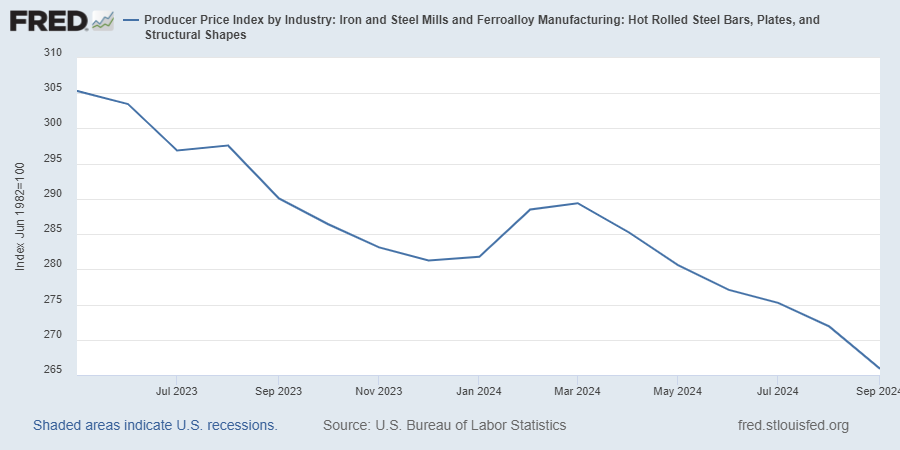

Here’s the Price Index for Hot Rolled Bars, Plate, and Structural Shapes.