September’s ISM Manufacturing Index (PMI) improved to a 61.1 reading, slightly better than August’s 59.9. This marks the 16th consecutive month of growth in the economy. While new orders held steady and backlogs of orders continued to grow, the manufacturing sector still faces challenges. Record-long material lead times, rising commodity prices, transportation difficulties, and COVID-related issues (absenteeism, shutdowns) are all hurdles that continue to plague manufacturers.

Consumer Confidence continued to slide for the third consecutive month, registering a 109.3 mark compared to August’s 115.2. The back to back to back declines in confidence indicate that consumers have grown more cautious and could pull back on spending. The current wave of COVID cases, combined with inflationary pressures were mentioned as factors in dampening sentiment.

WTI Oil began September at $68.59 per barrel, steadily climbing to finish the month at $75.03 per barrel. An energy crisis in China and Europe (to an extent) is being offset by an unexpected increase in U.S. crude inventories, balancing the price of oil and keeping it from racing further upward. Too many moving parts at the moment to predict where oil prices go for the balance of 2021, but rest assured that China’s plight will play a significant role.

The online US Oil Rig Count is at 528 which is up 20 compared to last month’s report and up 262 from October 2 of 2020 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

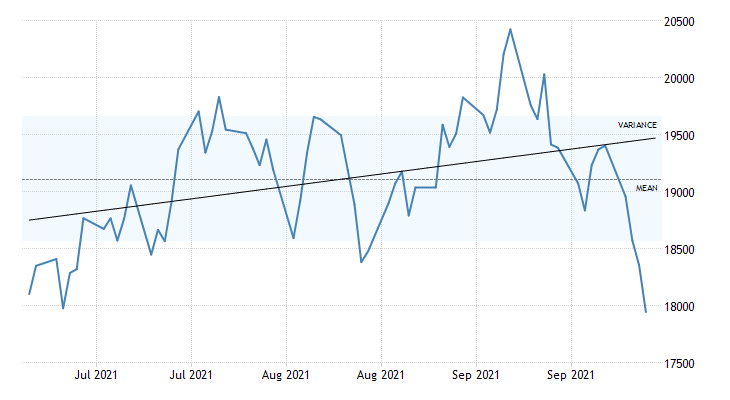

After peaking at $9.30/lb. on September 13th, Nickel prices entered into a free fall for the remainder of the month, eventually settling at $8.16/lb. (this after starting September at $8.90/lb.). The recent energy crisis in China is largely to blame for the precipitous drop in the commodity price. Multiple stainless steel mills in the country have been under pressure to curb output – thus lowering the need for Nickel. This situation is certainly worth monitoring in the coming weeks, not just for commodity prices, but for all goods coming from China.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Domestic steel mills announced an $80/ton increase into the market in September. This marks the eleventh consecutive month that producing mills have implemented a price increase. Only time will tell, but there is some sentiment that we may be at or near the apex of prices.

Commodity stainless and Duplex plate deliveries are currently in the 7 to 10 week range, while Nickel alloy plate deliveries are in the 10 to 14 week range. Carbon Steel plate mill deliveries continue to remain in the 8 to 12 week delivery range.

Welded tubing – Allocation and late deliveries of strip remain a drag on welded stainless and nickel tubing deliveries, keeping them in a range from 18 to 24 weeks. Carbon steel tubing deliveries remain mired in their own challenging situation, with allocation stifling the availability of raw material, leaving lead times anywhere from 10 to 18 weeks if strip is available.

Seamless tubing – Current schedules now reflect 8 to 16 weeks for carbon steel and 12 to 18 weeks for stainless. Seamless nickel alloy tubing continues to be hampered by raw material availability as some suppliers have narrowed their quantity of stocked hollows as well as alloys in inventory. As long as hollows are available, anticipate deliveries of seamless nickel tubing in the 14 to 18 week timeframe.

Suffice to say, the metal market is in a tremendous state of uncertainty and price volatility, so please don’t hesitate to reach out if you have any questions.

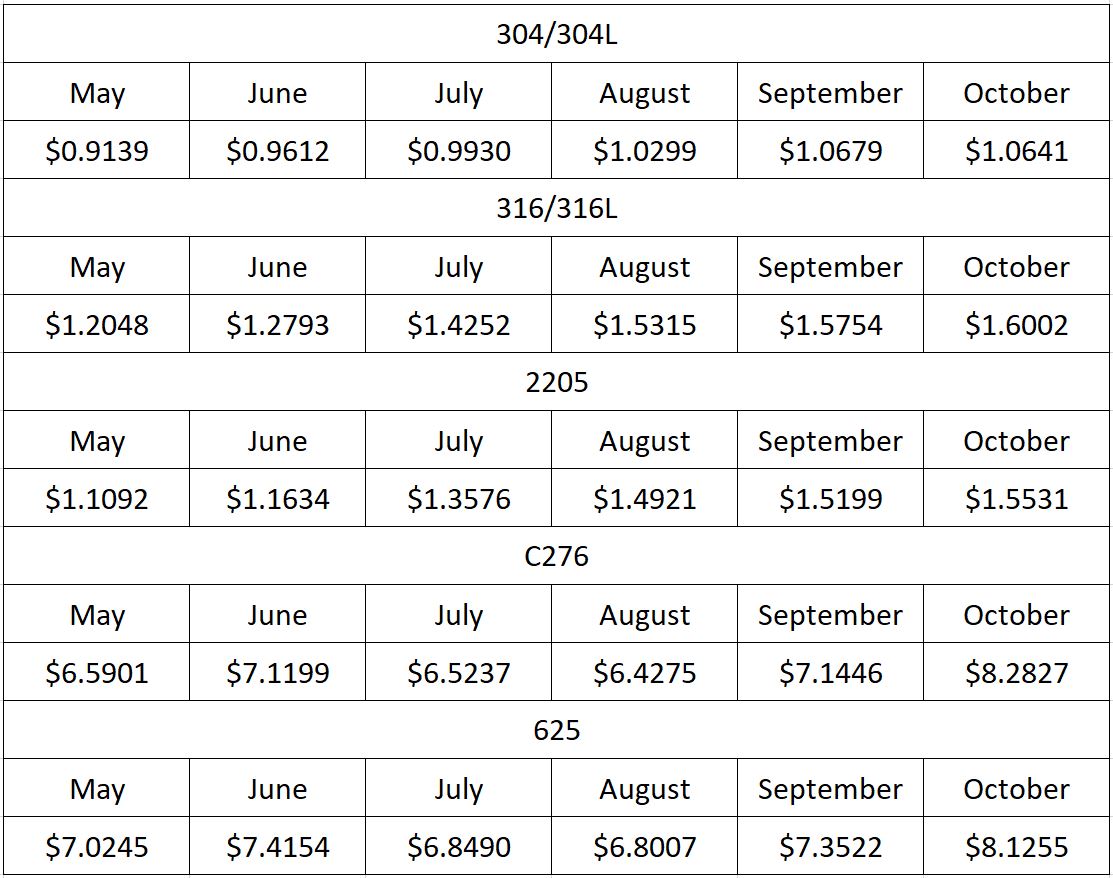

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.