Before we dive into the numbers, here’s a little lighthearted ASME Code humor for you.

How did the ASME Codebook handle rejection?

It just revised its specifications and moved on to the next challenge!

Now it’s time to buckle in because we’re off to the races with the latest industrial manufacturing news and information.

In September, the ISM Manufacturing PMI (Purchasing Manager’s Index) was recorded at 47.2 percent, the same as in August. This marked the 53rd consecutive month of overall economic expansion, following a single month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent over time typically reflects overall economic growth.)

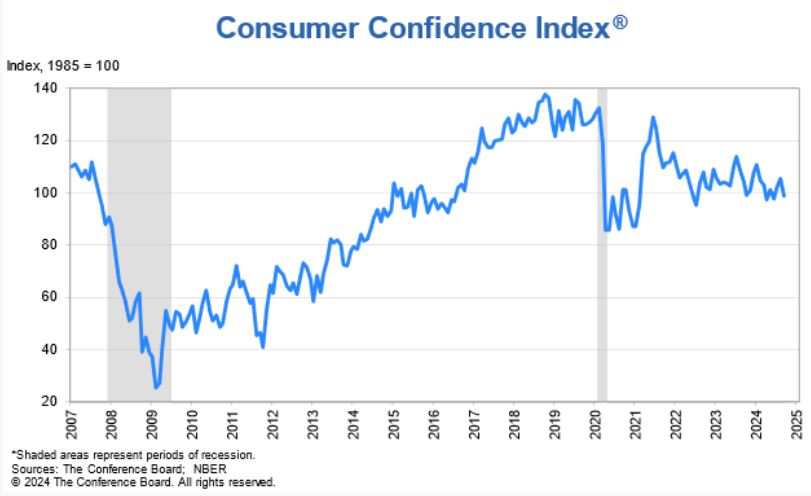

The Conference Board Consumer Confidence Index dropped to 98.7 (1985=100) in September, down from a revised 105.6 in August.

“Consumer confidence dropped in September to near the bottom of the narrow range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “September’s decline was the largest since August 2021 and all five components of the Index deteriorated. Consumers’ assessments of current business conditions turned negative while views of the current labor market situation continued to soften. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income.”

The New Orders Index remained in contraction at 46.1 percent, up 1.5 percentage points from August’s 44.6 percent.

The Production Index increased by 5 percentage points to 49.8 percent from 44.8 percent in August.

The Prices Index fell into contraction for the first time this year, dropping 5.7 percentage points to 48.3 percent from August’s 54 percent.

The Backlog of Orders Index rose slightly to 44.1 percent, up 0.5 percentage point from August’s 43.6 percent.

The Employment Index declined by 2.1 percentage points to 43.9 percent from August’s 46 percent.

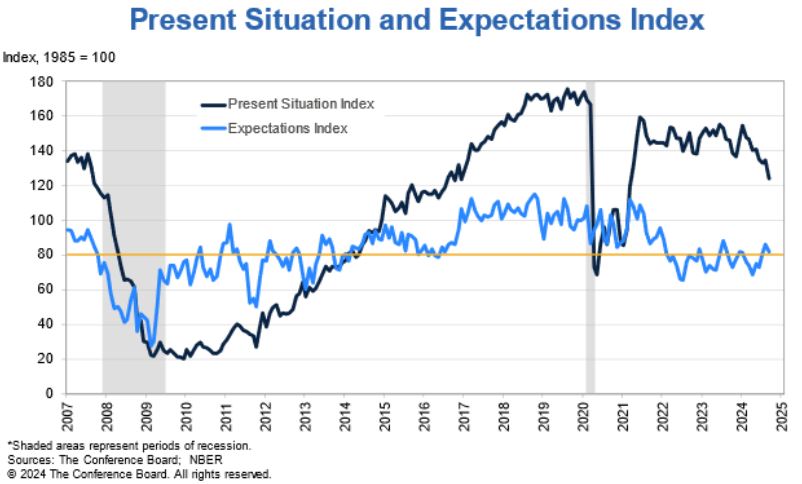

The Present Situation Index, which reflects consumers’ views on current business and labor market conditions, decreased by 10.3 points to 124.3.

Lastly, the Expectations Index, which gauges consumers’ short-term outlook for income, business, and labor market conditions, fell by 4.6 points to 81.7, staying above the critical threshold of 80, which typically signals an impending recession.

The data cutoff for the preliminary results above was September 17, 2024.

WTI Oil entered September at $74.061 per barrel. It trended down for the first third of the month, hitting a low of $65.750 per barrel. Prices bounced around for the remainder of the month, closing at $68.170 per barrel while on an upward trajectory. Prices have surged in the past week to a one-month high after U.S. President Biden stopped short of directly condemning the possibility of an Israeli attack on Iran’s oil facilities. In addition to the immediate impact such an attack would have on short-term supply, oil prices were also driven up by a risk premium in futures due to escalating geopolitical tensions in the Middle East. Tel Aviv had pledged to retaliate after Iran launched a series of ballistic missiles this week, intensifying its operations in Beirut as part of its ongoing conflict with Hezbollah.

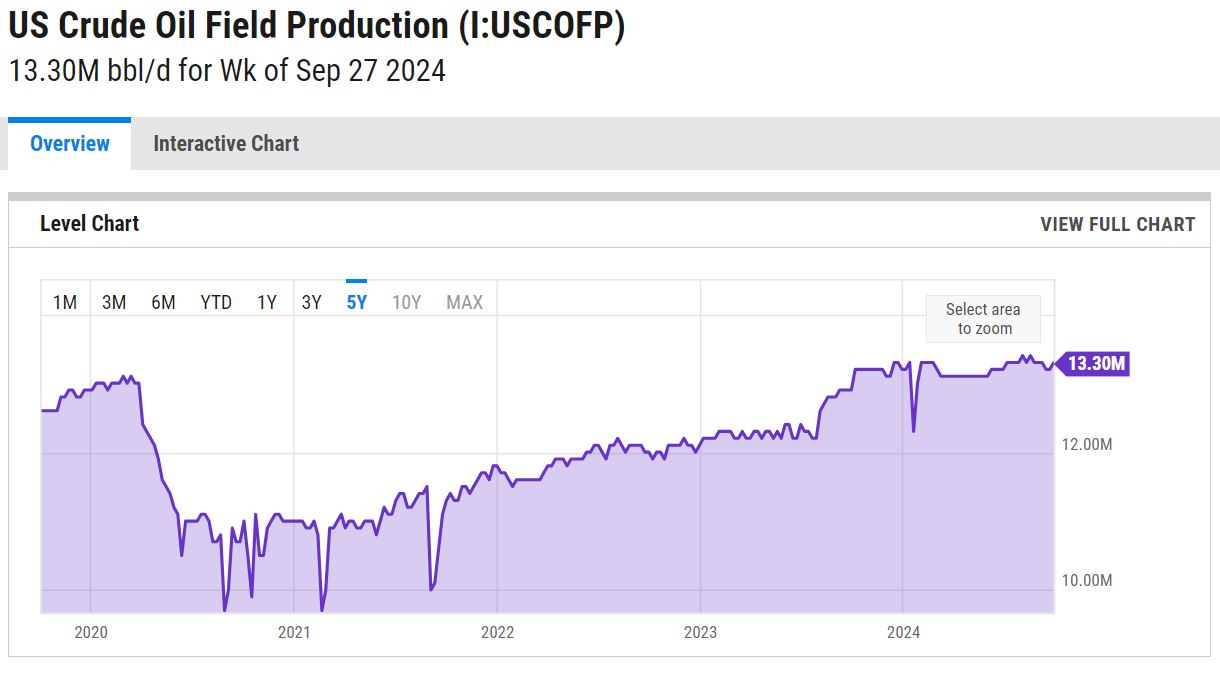

The online US Oil Rig Count is at 585 which is ? 3 compared to last month’s report and ? 34 from September 8 of 2023. This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing hydrocarbons which all of us use every day as fuel sources and finished products.

The number of rigs conducting oil and gas drilling in the United States continues to remain stagnant. This trend reflects the priority of drillers to focus on enhancing shareholder returns rather than expanding production coupled with the current administration’s desire to move away from fossil fuels. Additionally, uncertainty surrounds the economic outlook, leading the industry to remain cautious, especially compared to pre-pandemic times when the rig count showed a slower recovery over the past few years. To provide context, in 2019, 954 rigs were drilling for oil and gas in the U.S., and, in 2014, there were 1609 rigs before oil prices dropped below $20 per barrel at the end of that year.

However, solid oil prices will likely prevent the rig count from decreasing significantly and may even lead to a rebound in 2025. Currently, the West Texas Intermediate benchmark prices have been at or around $75 per barrel, sufficient for most drillers to be profitable.

Nickel entered September at $7.541 per pound then hit its monthly low on the 10th at $7.140 per pound. Pricing trended up the remainder of the month, closing at $7.952/lb. Nickel reached its highest level in over three months as base metals surged, driven by China’s most aggressive stimulus measures since the pandemic. China’s central bank announced steps to reduce borrowing costs, inject additional funds into the economy, and ease mortgage repayment pressures, including lowering medium-term loan rates for banks. At the same time, the U.S. Department of Labor expressed concerns about forced labor in Indonesia’s nickel industry, marking the first time Indonesian nickel has been added to its exploitation list. In response, Indonesia pledged to strengthen oversight of its commodities sector.

Tariffs have tightened. The White House announced new rules last month that strengthened tariffs on metals routed through Mexico. These rules build upon former President Donald Trump’s 2018 tariffs, which imposed a 25% tax on steel imports and a 10% tax on aluminum imports.

Although Mexico was granted an exemption to the tariffs in 2019, the new rules now require companies shipping steel and aluminum from Mexico to verify their origin. Officials report that 13% of steel and 6% of aluminum imported from Mexico originate from outside North America, including China, which produces half of the world’s steel. This announcement follows the Biden administration’s decision earlier this year to raise tariffs on $18 billion of Chinese imports, targeting goods such as electric vehicles, solar panels, semiconductors, syringes, and medical gloves.

The announcement coincides with a significant increase in US-China trade over recent decades, with imports exceeding $420 billion last year—up more than 300% since the turn of the century. However, last year’s imports represented a 20% drop from 2022, as tariffs have worked to narrow the trade deficit with China.

Domestic commodity stainless plate deliveries moved out to the 6 to 8 week range (was 5 to 6 weeks). Nickel alloy plates bumped out to 7 to 12 week range (was 6 to 9 weeks). Duplex plates followed the trend, pushing to the 7 to 12 week range (was 6 to 9 weeks). Domestic carbon steel plate mill deliveries continue to schedule in the 5 to 8 week range. Keep in mind, some plates will exceed the estimated ranges depending on the mill’s production schedule and slab availability. All eyes are on the East Coast ports due to the ongoing strike, which has been temporary paused until January 15th, 2025. This will directly affect domestic mills if foreign material is not flowing into the country as normal.

Welded tubing – Currently deliveries for domestically welded stainless tubing are in the 8 to 12 week range, leaning towards the long side. For import tubes, deliveries are anywhere from 16 to 30 weeks. Carbon steel tubing deliveries have lead times ranging anywhere from 6 to 8 weeks when strip is available. Welded nickel alloy tubing ranges from 12 to 14 weeks (up to 42 weeks for imports).

Seamless tubing – Current schedules reflect 6 to 26 weeks or more for carbon steel and 8 to 26 weeks for stainless. Seamless nickel tubing is being offered at the 8 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 40 to 44 week timeframe as most hollows are of foreign melt. Ward spoke with a domestic seamless tube mill and they warned that the ongoing east coast port strikes, which have been temporarily paused until January 15th, 2025, will directly affect their lead times due to all of their hollows coming from Europe.

Please don’t hesitate to reach out if you have any questions about the current state of our industry’s material supply chain.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollars per Metric ton.

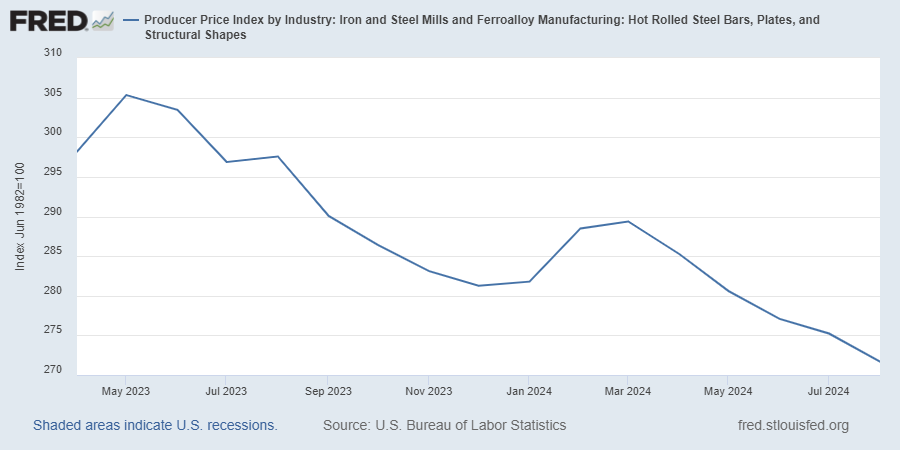

Here’s the Price Index for Hot Rolled Bars, Plate, and Structural Shapes.