The ISM Manufacturing Index (PMI) was fairly static month over month, registering a 59.9 reading in August compared to July’s 59.5. The good: new orders and production increased in August. The bad: the backlog of orders continues to grow as a result of supply chain bottlenecks and the struggle to find capable workers continues to persist.

Consumer Confidence fell to the lowest level in 6 months in August, coming in at 113.8 versus 129.1 in July. The rise of the Delta variant and inflationary pressures resulted in a less favorable view of current economic conditions and short-term prospects. Many analysts expect confidence to rebound as Americans are well-positioned with regard to cash on hand and savings levels.

WTI Oil slid back under $70 per barrel in August, but it didn’t fall too far. The commodity closed at $68.84 per barrel, after starting the month at $71.26 per barrel. Pricing for the balance of 2021 is poised to stick near the current level. Even though OPEC will begin to increase production by 400,000 barrels per day, they are still below pre-pandemic output levels. Combine that with continued strong demand and that’s a recipe for keeping the commodity price firmly above $60 per barrel.

The online US Oil Rig Count is at 508 which is up 17 compared to last month’s report and up 254 from August 28 of 2020 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

Nickel values dipped on a couple of occasions during August but managed to rebound as the price started the month at $8.85/lb. and ended up at $8.90/lb. There are a number of opinions on where nickel prices go from here, but it looks like the value will certainly stick above $8.00/lb. well into 2022. Demand for stainless and EV batteries appears poised to stay steady, providing a relatively predictable price floor.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Sounding like a broken record, domestic steel mills announced an $85/ton increase into the market in August. This marks the tenth consecutive month that producing mills have implemented a price increase. This truly is an unprecedented market.

The plate, sheet, and tube supply chains are still in the process of working themselves towards previous norms, with tubing and sheet continuing to take the longest to recover. Commodity stainless and Duplex plate deliveries currently range from 7 to 9 weeks, while Nickel alloy plate deliveries are in the 10 to 12 week range. Carbon Steel plate mill deliveries continue to remain in the 8 to 12 week delivery range.

Tubing deliveries continue to marginally contract. Access to strip and hollows to make tubes is improving, albeit slowly. Welded stainless tube offers recently offered at 30 weeks production have been reeled into the 23 to 24 week range. Here’s the latest summary of both the welded and seamless product offerings:

Welded tubing – Allocation and late deliveries of strip continue to plague welded stainless and nickel tubing deliveries to a range from 18 to 24 weeks or so. Carbon steel tubing deliveries remain mired in their own challenging situation, with allocation stifling the availability of raw material, leaving lead times anywhere from 10 to 18 weeks if strip is available.

Seamless tubing – Carbon and stainless seamless tubing. Current schedules now reflect 8 to 16 weeks for carbon and 14 to 18 weeks for stainless. Seamless nickel alloy tubing continues to be hampered by raw material availability as some suppliers have narrowed their quantity of stocked hollows as well as alloys in inventory. As long as hollows are available, anticipate deliveries of seamless nickel tubing in the 14 to 18 week timeframe.

Suffice to say, the metal market is in a tremendous state of uncertainty and price volatility, so please don’t hesitate to reach out if you have any questions.

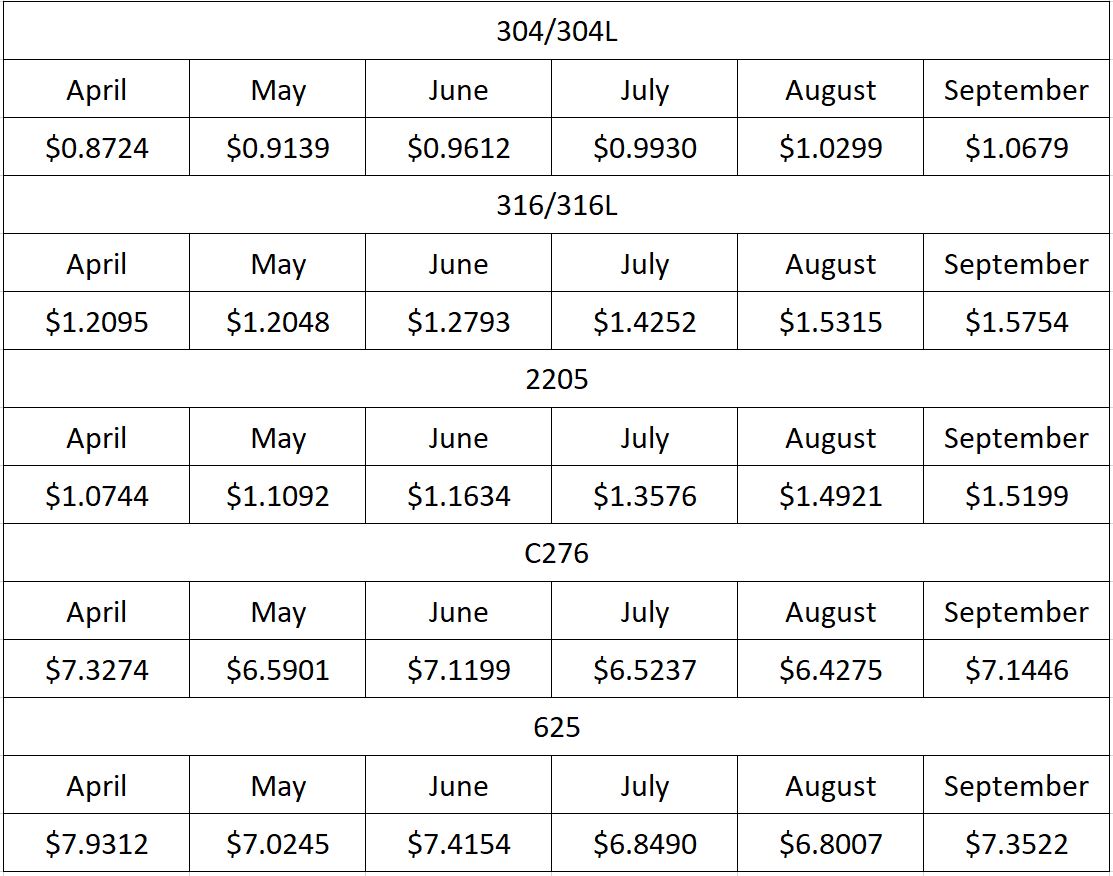

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.