The ISM Manufacturing Index (PMI) fell to 46.9 in May 2023 from 47.1 in April. The reading indicated a seventh consecutive month of contraction in the manufacturing sector, as companies “manage outputs to better align with demand in the first half of 2023 and prepare for growth in the late summer/early fall period. However, there is evidently increased business uncertainty in May,” stated Timothy Fiore, Chair of the ISM Manufacturing Business Survey Committee.

The Conference Board Consumer Confidence Index fell in May to 102.3, down from an upwardly revised 103.7 in April. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased to 148.6 (1985=100) from 151.8 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased slightly to 71.5 (1985=100) from 71.7. The Expectations Index has now remained below 80—the level associated with a recession within the next year—every month since February 2022, except for a brief uptick in December 2022.

WTI Oil entered May at $75.660 per barrel, the highest we would see the entire month. Prices bounced around during the month of May and closed the month out at $68.090 per barrel. Saudi Arabia pledged to reduce output by another 1 million barrels per day from July. That would bring the country’s production level to around 9 million barrels per day next month, the lowest in years. Energy Minister Prince Abdulaziz bin Salman said he “will do whatever is necessary to bring stability to this market” at a high-stakes OPEC+ meeting over the weekend. Meanwhile, Russia made no commitment to reduce output further and the United Arab Emirates was allowed to raise output targets for next year. Still, lingering demand concerns, especially from top crude importer China, continued to weigh on sentiment. The prospect of further interest rate hikes from the US Federal Reserve also clouded the outlook for commodity markets.

The online US Oil Rig Count is at 696 which is down 52 compared to last month’s report and down 31 from June 3 of 2022 (a high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

Nickel entered May at $10.982 per pound. Prices quickly hit their monthly high at $11.317 per pound by May 2nd. Nickel then took a slide through the remainder of the month, landing at $9.268 per pound. The International Nickel Study Group said the nickel market faces the largest demand-supply surplus in at least a decade amid higher production from Indonesia and the Philippines. The country’s output has already grown to 1.58 million tonnes in the previous year, accounting for nearly half the worldwide supply. Meanwhile, on the demand side, China’s unstable recovery weighed on the sentiment. Furthermore, nickel remained the worst-performing contract on the LME so far in 2023, dropping by over 20%.

Below is the 90 day Nickel Price Trend (US$ per tonne).

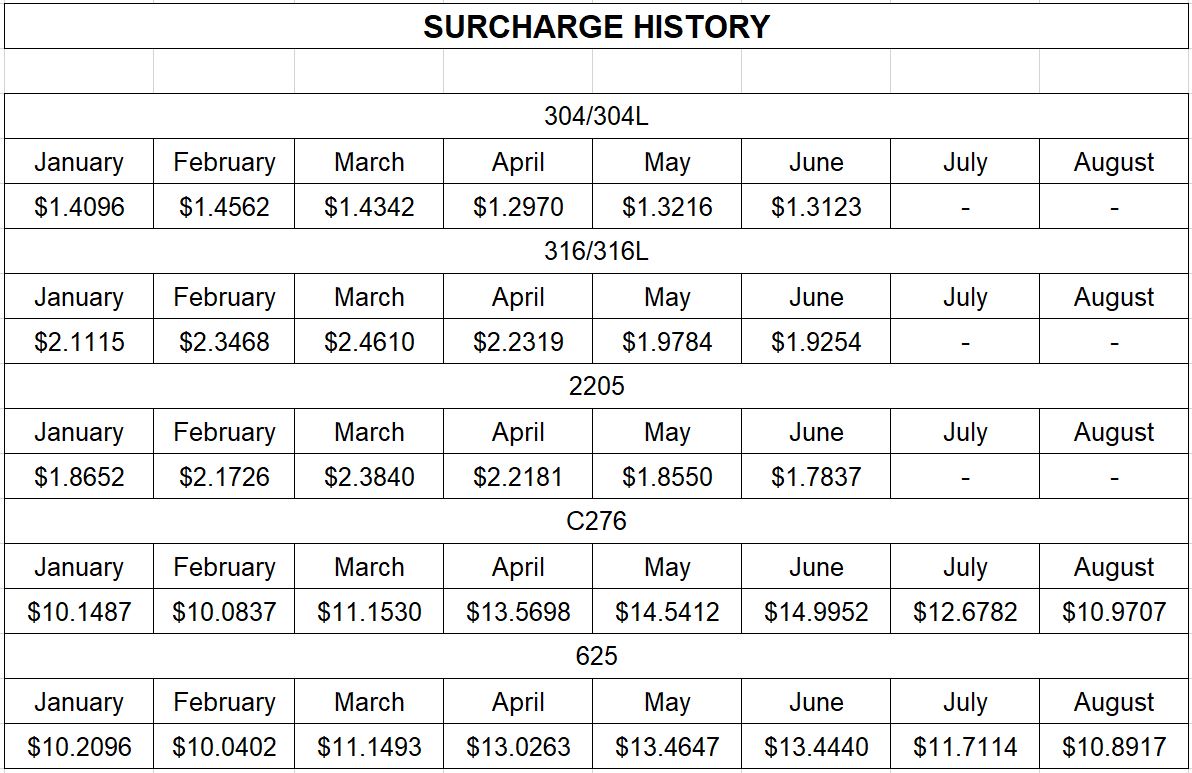

Molybdenum, a metal mainly used as an alloying agent in stainless steel, has been on a crazy ride since the beginning of 2023. On May 12th we saw a 9.98% decrease in price. Prices are sill 11.57% higher than seen at the beginning of 2023. This downward trend we have seen since March 2nd is welcome as prices begin to get back to “normal”. Surcharges decrease once again for June, getting us closer to the figures seen in December of 2022.

Commodity stainless and duplex plate deliveries have pulled in slightly to a 12 to 14 week range, along with Nickel Alloy plates pulling into a 13 to 14 week range. Carbon steel plate mill deliveries continue to reside in the 6 to 10 week delivery range. Keep in mind some duplex and nickel alloy plates will exceed the estimated ranges depending on the mill’s schedule.

Welded tubing – Currently deliveries for domestically welded stainless tubing are in the 6 to 12 week range, whether in small or large quantities (Up to 26 weeks for import). Carbon steel tubing deliveries have lead times ranging anywhere from 6 to 15 weeks when strip is available. Welded nickel alloy tubing ranges from 18 to 42 weeks.

Seamless tubing – Current schedules reflect 8 to 20 weeks or more for carbon steel (24 to 26 weeks for Western European carbon seamless) and 8 to 35 weeks for stainless. Seamless nickel tubing is being offered at the 8 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 20 to 35 week timeframe.

Please don’t hesitate to reach out if you have any questions about the current state of our industry’s material supply chain.

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollars per Metric ton.

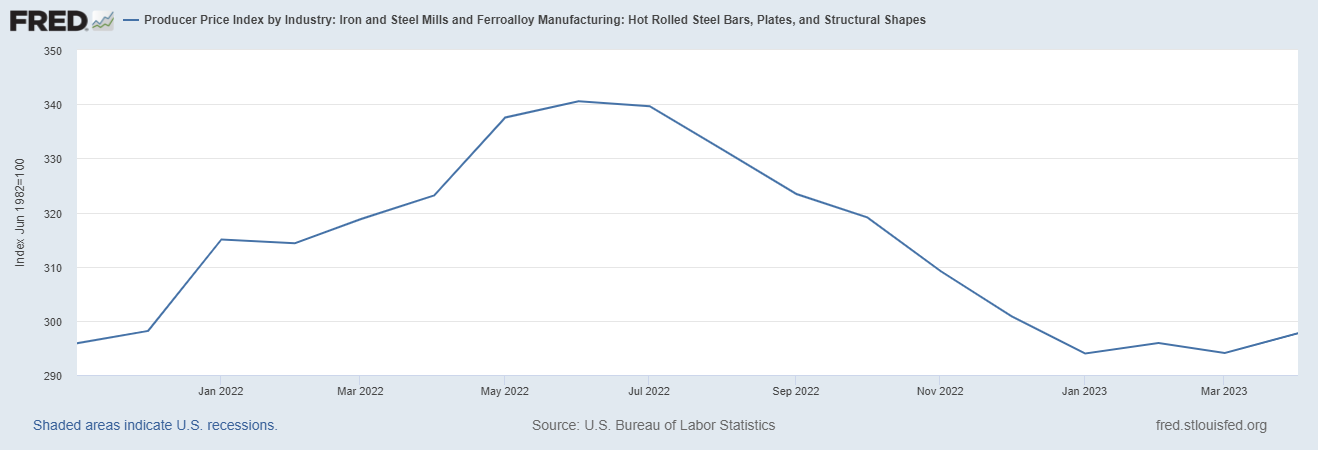

Here’s the Price Index for Hot Rolled Bars, Plate, and Structural Shapes.