The ISM Manufacturing Index (PMI) edged higher to 46.4 in July 2023 from a nearly three-year low of 46 in June, but below market expectations of 46.8. The reading pointed to a ninth straight month of contraction in factory activity, as demand remains weak, production slowed due to lack of work, and suppliers continue to have capacity. New orders (47.3 vs 45.6), production (48.3 vs 46.7), inventories (46.1 vs 44), and backlog of orders (42.8 vs 38.7) shrank slightly less while prices went down at a smaller pace (42.6 vs 41.8). On the other hand, employment fell more (44.4 vs 48.1) and the supplier deliveries index increased to 46.1 vs 45.7, indicating faster deliveries. Meanwhile, the Customers’ Inventories Index reading indicated appropriate buyer/supplier tension, which is neutral to slightly positive for future production.

The Conference Board Consumer Confidence Index rose again in July to 117.0 (1985=100), up from 110.1 in June. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—improved to 160.0 (1985=100) from 155.3 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—improved to 88.3 (1985=100) from 80.0 in June. Importantly, Expectations climbed well above 80—the level that historically signals a recession within the next year. Despite rising interest rates, consumers are more upbeat, likely reflecting lower inflation and a tight labor market. Although consumers are less convinced of a recession ahead, we still anticipate a slight dip before yearend.

WTI Oil entered July at $69.910 per barrel. Prices trended upward for the entire month of July, closing at $81.800 per barrel. This increase is underpinned by Saudi Arabia and Russia’s announcement that they would extend voluntary supply cuts through next month. Saudi Arabia said on Thursday it would extend its 1 million barrels per day production cut for another month, while Russia said it will also reduce its oil exports by 300,000 bpd in September. Those announcements came a day ahead of an OPEC+ meeting, where the group is expected to largely maintain current oil output policy of limiting supply into 2024. Elsewhere, US crude inventories fell by a record 17 million barrels last week due to increased refinery runs and strong crude exports but at 439.8 million barrels, inventories are only 1% below the five-year average for this time of the year. On the demand side, meanwhile, concerns about a subdued recovery in China and most European countries continued to weigh on sentiment.

The online US Oil Rig Count is at 664 which is down 16 compared to last month’s report and down 103 from July 29 of 2022. This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing hydrocarbons which all of us use every day as fuel sources and finished products. The number of rigs conducting oil and gas drilling in the United States continues to decrease. This decline in the U.S. rig count has occurred in 10 out of the last 11 weeks. Even the Permian Basin, which is the most productive region for oil and gas production in America, has experienced a drop in the number of operating rigs, with 337 currently compared to 342 last week and 350 a year ago.

This trend reflects the priority of drillers to focus on enhancing shareholder returns rather than expanding production coupled by the current administration’s desire to move away from fossil fuels. Additionally, there is uncertainty surrounding the economic outlook, leading the industry to remain cautious, especially compared to pre-pandemic times when the rig count showed a slower recovery over the past few years. To provide context, in 2019, there were 954 rigs drilling for oil and gas in the U.S. and, in 2014, there were 1609 rigs before oil prices dropped below $20 per barrel at the end of that year.

However, the solid oil prices will likely prevent the rig count from decreasing significantly and may even lead to a rebound later this year. Currently, the West Texas Intermediate benchmark prices have been at around $75 per barrel, which is sufficient for most drillers to be profitable. Consequently, the U.S. is still expected to set a new annual oil production record in 2023, with a projected 12.4 million barrels per day, slightly surpassing the 2019 record of 12.3 million bpd.

Nickel entered July at $9.256 per pound. Prices trended upward until they reached its month high on July 25th at $10.070 per pound. Nickel closed the month at $10.014 per pound. China, the top importer, has pledged to roll out more measures to support the construction sector, thus lifting the demand for a commodity. Also, Standard and Poor’s (S&P) raised its forecast for global car manufacturing in 2023, 2024, and 2025, increasing the need for semiconductors materials. On the political front, the US imposed sanctions on one of Russia’s main copper and nickel producers. Still, the overall outlook remained bearish, with the market facing the largest demand-supply surplus in at least a decade due to higher output from Indonesia and the Philippines. Weighing on the sentiment further, new plants in China and Indonesia started converting intermediate forms of nickel into metal that can be delivered on the LME, which could boost LME-deliverable supplies by 35% compared to 2022 levels.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Commodity stainless plate deliveries look to have pulled in slightly to a 10 to 12 week range, Nickel alloy plates maintained in the 12 to 14 week range. Duplex plates are currently sitting in the 12 to 13 week range. Carbon steel plate mill deliveries continue to reside in the 6 to 10 week delivery range. Keep in mind some duplex and nickel alloy plates will exceed the estimated ranges depending on the mill’s schedule.

Welded tubing – Currently deliveries for domestically welded stainless tubing has been seen in the 10 to 14 week range, whether in small or large quantities (Up to 26 weeks has been seen for import). Carbon steel tubing deliveries have lead times ranging anywhere from 10 to 12 weeks when strip is available. Welded nickel alloy tubing ranges from 14 to 42 weeks.

Seamless tubing – Current schedules reflect 10 to 20 weeks or more for carbon steel (24 to 26 weeks for Western European carbon seamless) and 6 to 35 weeks for stainless. Seamless nickel tubing is being offered at the 8 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 20 to 32 week timeframe.

Please don’t hesitate to reach out if you have any questions about the current state of our industry’s material supply chain.

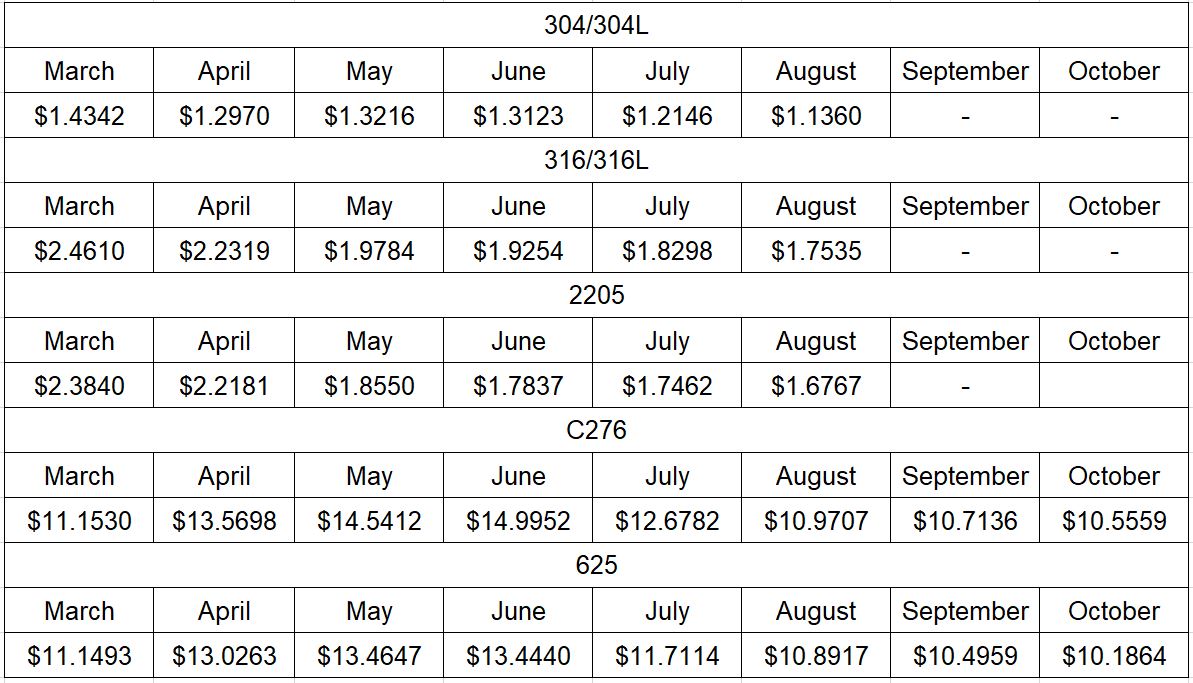

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollars per Metric ton.

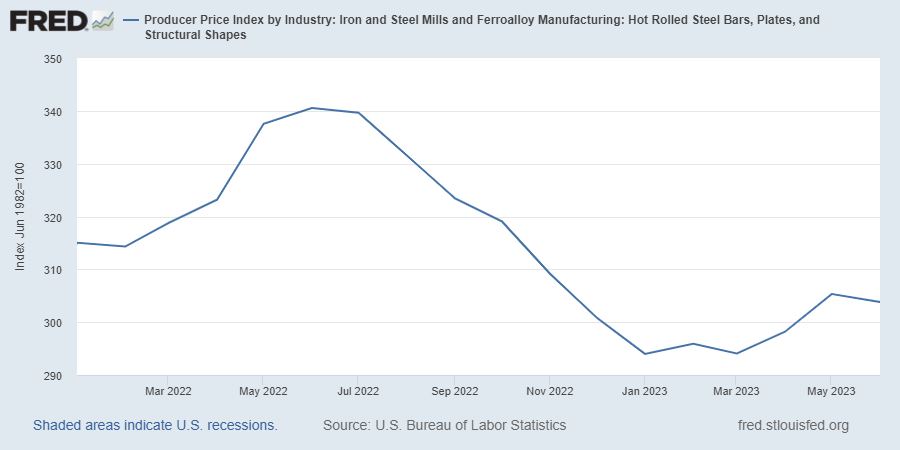

Here’s the Price Index for Hot Rolled Bars, Plate, and Structural Shapes.