|

The May ISM Manufacturing Index (PMI) continued to illustrate a strong recovery, registering a 61.2 mark, a slight increase from April’s 60.7. Remarkably, the manufacturing sector could be growing faster if not for supply-side bottlenecks. To put the current situation into a broader context, May saw the longest delivery times for input materials since 1974. Raw material delays, labor shortages, and healthy demand pressure point to inflation lingering for the foreseeable future.

Consumer Confidence held steady in May, barely moving off of April’s 117.5 reading to come in at a 117.2 mark. While the present day consumer assessment remains strong, there are potential headwinds on the horizon. Some optimism has waned, likely influenced by expectations of higher inflation, less government support, and a deceleration of growth. Even with those potential spoilers, consumers remain largely optimistic, with vaccinations continuing to increase in lockstep with COVID-19 cases declining.

WTI Oil checked in at $66.63 per barrel to close May, compared to $64.49 per barrel to open the month. As evidenced by the delta between the opening and closing values, May was a relatively steady month for oil. As we head into the summer months, continued manufacturing sector progress and pre-COVID levels of travel in the U.S. are expected, which will likely propel the price of oil past $70 per barrel.

The online US Oil Rig count is at 457 which is up 17 compared to last month’s report and up 156 from May 29 of 2020 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel). This key and leading indicator shows the current demand for products used in drilling, completing, producing and processing of hydrocarbons which all of us use every day as fuel sources.

Nickel began May at the $8.01/lb. mark, spent much of the month below that threshold, yet recovered to close at $8.22/lb. The end of May saw Nickel stored in LME warehouses fall into the negative for the year (less on hand now than in January). On top of that, the United Steel Workers union at the Vale Inco nickel mine in Canada has elected to strike. If the strike persists and stocks continue to get depleted, these two factors should keep the commodity above the $8.00/lb. level for the month of June, if not longer.

Below is the 90 day Nickel Price Trend (US$ per tonne).

The seemingly never ending price increase streak continued in May, with domestic steel plate mills implementing a $100/ton adder. This marks the seventh consecutive month that producing mills have implemented a price increase. As long as demand continues to outpace supply, the environment will continue to support higher material costs.

The USW and Allegheny Technologies labor dispute is now over two months old. The plate, sheet, and tube supply chains remain in disarray as a result. Congestion on the supply side continues to complicate life for fabricators and end users alike. New Castle Stainless is offering commodity stainless and Duplex deliveries from 7 to 9 weeks, while Special Metals nickel alloy plate deliveries are in the 13 to 16 week range. Carbon Steel plate mill deliveries continue to remain in the 8 to 10 week delivery range.

Tubing deliveries have only become more uncertain since our last update. Access to strip and hollows to make tubes is the key driver of availability at the present time. It is such a challenging environment that at least one major tube mill is quoting 30 weeks or more for welded stainless tubing. That said, here’s the latest summary of both the welded and seamless product offerings:

Welded tubing – December’s announcement that ATI was beginning to exit the commodity stainless sheet and strip market hamstrung the welded tube market to a degree – taking capacity out of the market and putting more stress on the other two domestic stainless mills (NAS, Outokumpu) to fill the void of supply. The March 30th USW strike against ATI is now in its third month, and the tangential impacts of this work stoppage are too numerous to list. Allocation and late deliveries of strip have pushed welded stainless tubing deliveries to a range from 14 to 18 weeks or more if strip is available, with deliveries of 16 to 20 weeks as the current range for nickel alloys. Carbon steel tubing deliveries remain mired in their own challenging situation, with allocation stifling the availability of raw material, pushing lead times anywhere from 9 to 16 weeks if strip is available.

Seamless tubing – Carbon and stainless tubing no longer enjoy their delivery advantages. Current schedules have been increased due to demand and now reflect 8 to 16 weeks for carbon and 14 to 16 weeks for stainless. Seamless nickel alloy tubing continues to be hampered by raw material availability as some suppliers have narrowed their quantity of stocked hollows as well as alloys in inventory. As long as hollows are available, anticipate deliveries of seamless nickel tubing in the 14 to 16 week timeframe.

There continues to be a lot of turmoil in the metal market right now so please don’t hesitate to reach out if you have any questions.

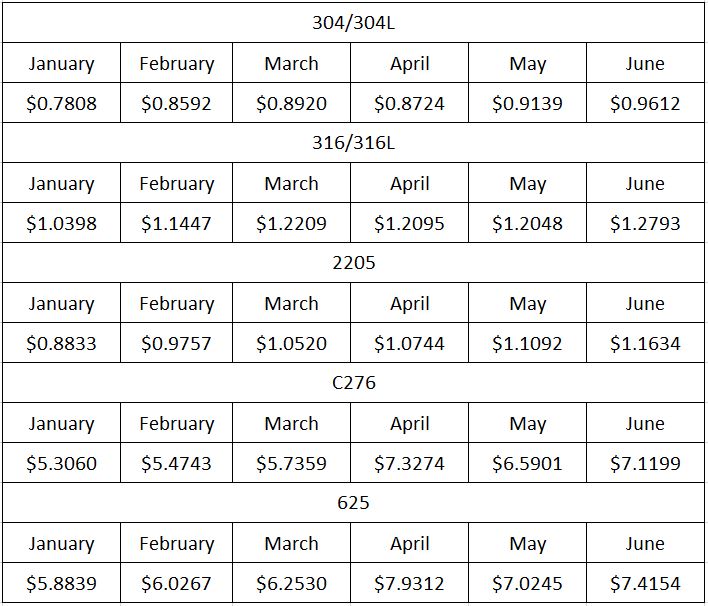

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276 and 625.

|