|

Registering a 59.3 reading, the October ISM Manufacturing Index (PMI) rose from September’s 55.4. The new orders sub-category reached the highest level in nearly 17 years, providing support for the overall increase in the index. After months of job losses, manufacturing employment expanded for the first time since July of 2019. Hopefully this momentum continues as we head towards 2021.

October saw Consumer Confidence remain fairly steady, declining slightly to 100.3 from September’s 101.3 mark. Rising coronavirus cases, a stagnant job market, and the uncertainty that accompanies election season contributed to this month’s confidence reading.

October saw WTI Oil slide a bit, falling from $38.72 per barrel level down to $35.79 per barrel to close the month. The depressed value is largely attributed to a hedge on lack of demand as a result of the current surge in COVID-19 cases across Europe and the US.

The online US Oil Rig count is at 296 which is up 30 compared to last month’s report and down 526 from November 1 of 2019. This roughly equates to a 60-70% drop since this time last year with these historic lows. This key and leading indicator shows the current demand for products used in drilling, completing, producing and processing of hydrocarbons which all of us use every day as fuel sources.

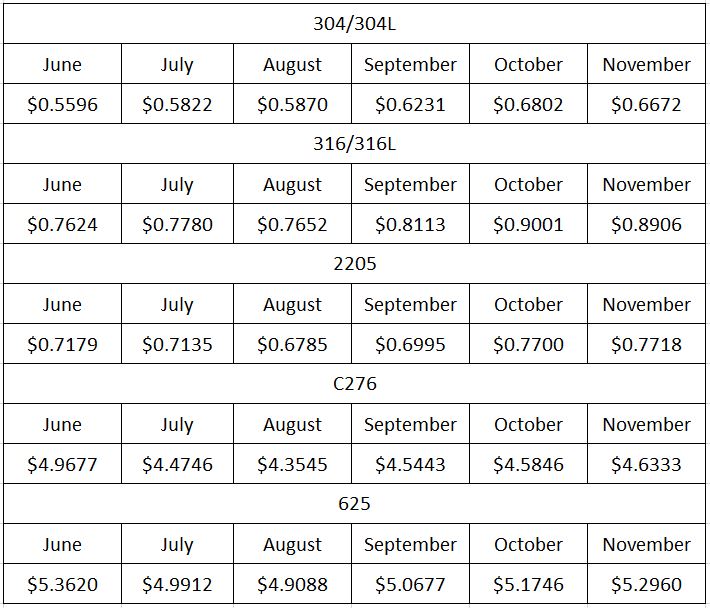

October saw Nickel begin the month at $6.60/lb. and then steadily climb as high as $7.22/lb. before settling at $6.87/lb. at month end. Electric vehicle demand speculation and COVID-related mine closures spurred the run above $7.00/lb. Short and medium term sentiment points to a potential oversupply position in Nickel, with values expected to dampen. On a related note, domestic stainless and duplex plate producers announced $.03/lb. increases on plate mill plate products effective with December shipments.

|