May’s ISM Manufacturing Index (PMI) increased marginally to 56.1 from April’s 55.4 mark. May’s data indicates the 24th consecutive month of economic expansion. Survey respondents continue to mention supply chain and pricing challenges as their top issues to confront. Analysts foresee the manufacturing sector continuing to be busy in the coming months, trying to satisfy demand amid sizable backlogs.

Consumer Confidence slipped again in May, falling from April’s revised 108.6 reading to 106.4. Competing forces are providing balance at present time, with high inflation and rising interest rates on one side versus the strongest labor market in decades on the other side. The American consumer has shifted from spending on big ticket items (cars, appliances) to services (dining out, travel) and should keep up this trend throughout the summer months.

WTI Oil spent the month of May over $100 per barrel (save for one day at $99.76). It began at $102.41/barrel, then found a price floor of $110 before finally closing at $114.67 per barrel. There is chatter that OPEC+ may increase production in the coming weeks. Whatever the size of the increase, the odds are that it will not be enough extra supply to offset the Russian oil that is absent from the market.

The online US Oil Rig Count is at 727 which is up 22 compared to last month’s report and up 271 from June 4 of 2021 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

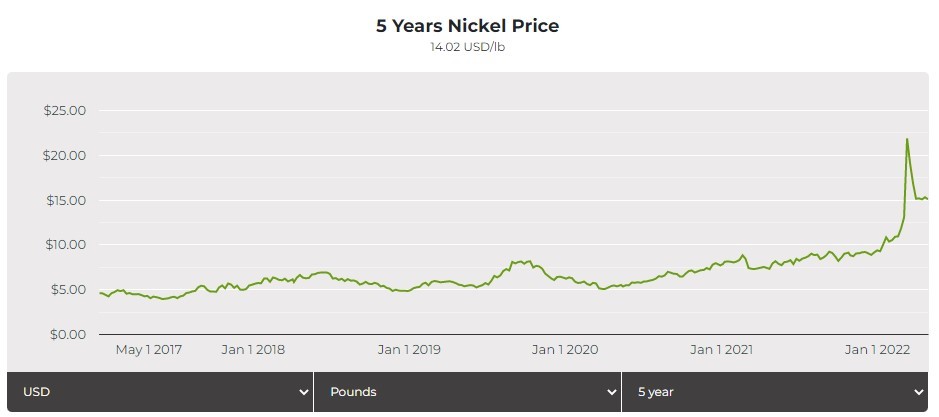

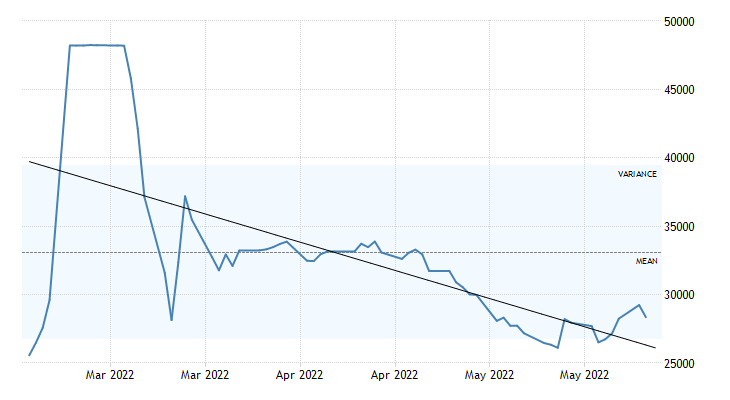

The month of May served as something of a reset for Nickel, as the price fell more in line with actual supply and demand rather than investor driven values. The commodity started the month at $14.54/lb. and quickly corrected to the band between $12 and $13, eventually closing at $12.90/lb. There are likely to be undulations in the market in the near term, but pricing is unlikely to escalate appreciably.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Domestic steel mills announced a $50 per ton price increase in May, effective for all non-contract orders set to ship in July and beyond.

Commodity stainless and Duplex plate deliveries remain in the 8 to 11 week range, while Nickel alloy plates range from 14 to 26 weeks. Carbon Steel plate mill deliveries reside in the 6 to 12 week delivery range.

Welded tubing – Stainless strip supply is getting better, allowing for some deliveries in the 10 to 16 week range, with larger quantity orders remaining in the window of 18 to 29 weeks. Carbon steel tubing deliveries have lead times ranging anywhere from 8 to 12 to 20 weeks when strip is available. Welded nickel alloy tubing ranges from 16 to 26 weeks, with some cases of 30 week deliveries.

Seamless tubing – Current schedules reflect 8 to 22 weeks or more for carbon steel (26 to 30 weeks for Western European carbon seamless) and 8 to 30 weeks for stainless. Seamless nickel tubing is being offered at the 10 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 20 to 32 week timeframe.

The metal market is still in a tremendous state of uncertainty and price volatility, so please don’t hesitate to reach out if you have any questions.

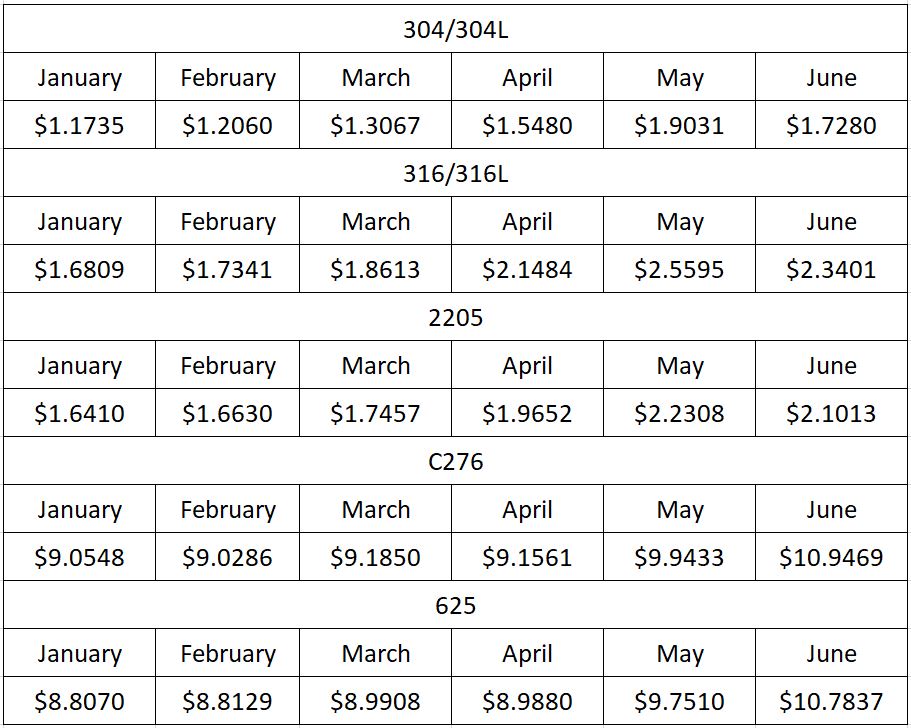

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

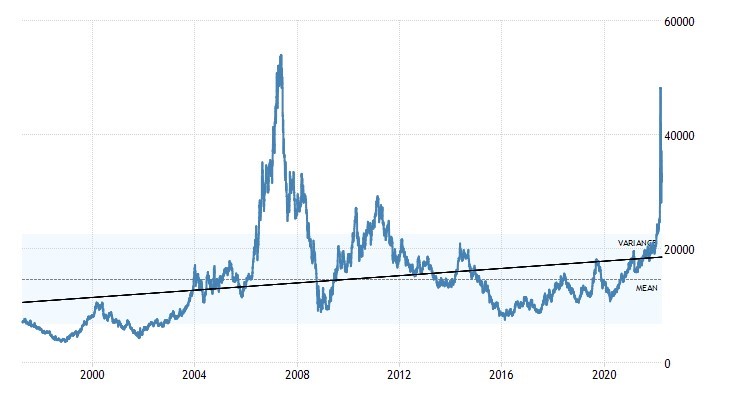

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollar per Metric ton.

Industrial Metal Pricing – Change Due War in Ukraine and shutdown of the London Metal Exchange (LME) in March of 2022