Improving off of January’s 58.7 level, February’s ISM Manufacturing Index (PMI) registered a 60.8 reading – marking the ninth consecutive month of manufacturing sector expansion. New orders, production, and employment measures all expanded at higher paces to help push February’s index reading upward. Also of note, logistics challenges and depleted supply chains are increasing material costs with no short term relief in sight.

Consumer Confidence continued to progress in February, improving to 91.3 from January’s 88.9 reading. Current business conditions, an improving labor market, and falling COVID-19 infections all contributed to the increase in confidence. The prospect of an additional fiscal stimulus package in combination with increasing vaccination numbers should further propel consumer sentiment as we head into the spring months.

WTI Oil continued to climb in value during February, eventually settling at $61.50 per barrel at month end, from a $53.55 per barrel starting position. OPEC production cuts in combination with increasing demand from manufacturers worldwide have provided the upward boost to prices. Look for oil to remain in the $60 per barrel range so long as the OPEC states and their allies exercise constraint.

The online US Oil Rig count is at 402 which is up 10 compared to last month’s report and down 388 from February 28 of 2020. This roughly equates to a 50% drop since this time last year with these historic lows. This key and leading indicator shows the current demand for products used in drilling, completing, producing and processing of hydrocarbons which all of us use every day as fuel sources.

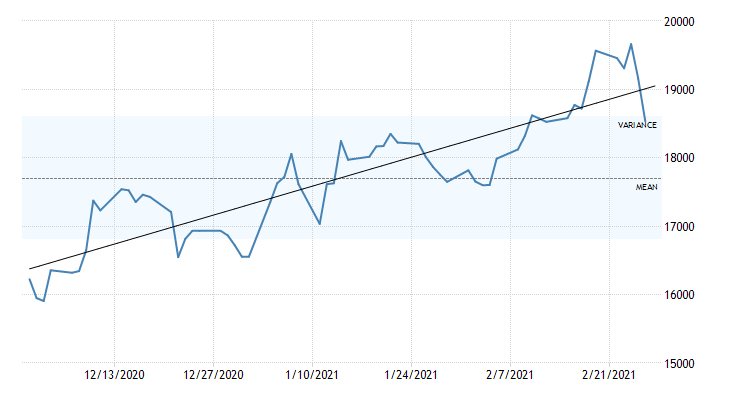

Nickel’s steady rise continued in February. Starting at the $8.10/lb. level, Nickel rose as high as $8.94/lb. before eventually closing at $8.42/lb. To put that performance in perspective, the last time the commodity was valued that high was back in 2014. Also note that on the day when Nickel peaked at $8.94/lb., Elon Musk tweeted his disdain for the element’s supply chain, resulting in a $.50/lb. loss in value in the last two business days on the month.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Continuing to rise further, domestic steel plate mills pushed through a $70/ton price increase in late February. It remains to be seen how long the bull market for steel prices lasts, but at least for the short term, we’re all going to keep paying more.

Domestic stainless mills continue to offer deliveries from 7 to 8 weeks, while Duplex stainless deliveries and Nickel alloy plate deliveries are in the 8 to 10 week range. Carbon Steel plate mill deliveries are trending towards 7 to 9 week deliveries at present time.

Tubing deliveries range from 4-8 weeks for stainless steel depending upon stock availability and up to 8-14 weeks for nickel alloys. Carbon steel tubing deliveries are still carrying longer lead times anywhere from 6-16 weeks.

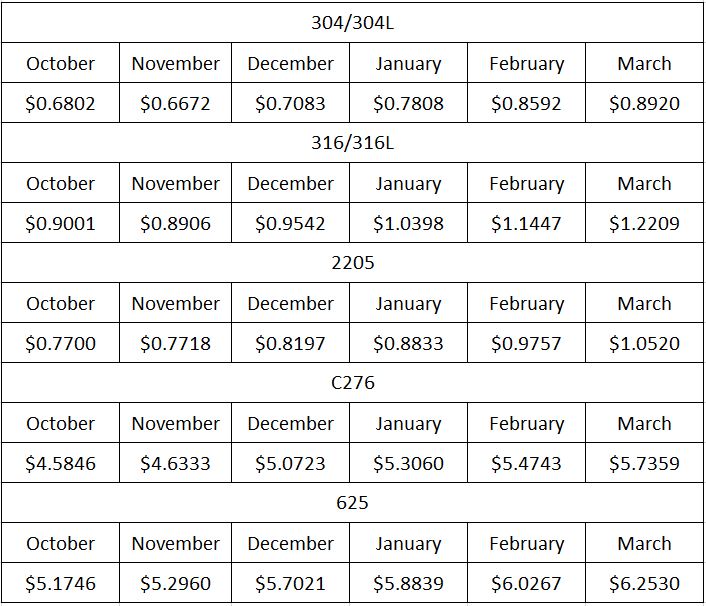

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276 and 625.