The ISM Manufacturing Index (PMI) retreated slightly in October, registering a 60.8 reading compared to September’s 61.1. This still marks the 17th consecutive month of growth, despite the slight drawback. The October reading is more impressive when you consider the supply chain hurdles, logistics difficulties, and labor shortages that have been weighing on manufacturers. Simply put, demand remains stronger than those negative forces and appears poised to stay that way in the short term.

Consumer Confidence reversed course from declines in the previous three months, rising to a 113.8 reading in October, up from September’s 109.8. The combination of the Delta variant surge leveling off and optimism about employment and income prospects was enough to push sentiment higher in the face of rising inflation. Signs point to a very healthy and active holiday shopping season, which should help buoy consumer activity in the final two months of 2021.

WTI Oil continued to climb in October, increasing from $75.88 per barrel at the start of the month to finish at $83.57 per barrel. Conventional wisdom points to oil prices sticking at or above the $80 per barrel level for the balance of 2021. Supplies remain tight and demand is staying strong. OPEC and Russia have agreed to increase production, but at a measured pace, surely designed to keep prices elevated.

The online US Oil Rig Count is at 544 which is up 16 compared to last month’s report and up 248 from October 30 of 2020 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

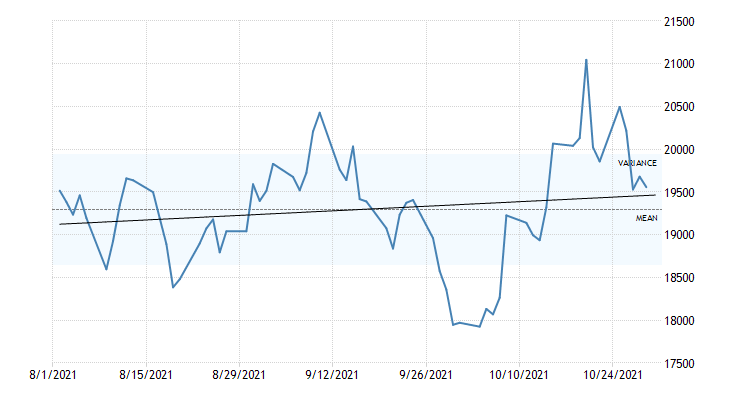

Nickel reversed course in October, racing from $8.16/lb. at the beginning of the month, to as high as $9.51/lb., before finally settling at $8.84/lb. to close the month. Power rationing in China and supply concerns from Indonesia and the Philippines contributed to the commodity price increase.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Domestic steel mills announced a $50/ton increase into the market in October, marking the twelfth consecutive month that producing mills have implemented a price increase. Any pricing relief will now have to wait until 2022 to arrive.

Commodity stainless and Duplex plate deliveries are currently in the 7 to 10 week range, while Nickel alloy plate deliveries are in the 10 to 20 week range. Carbon Steel plate mill deliveries continue to remain in the 8 to 12 week delivery range.

Welded tubing – Allocation and late deliveries of strip remain a drag on welded stainless and nickel tubing deliveries, keeping them in a range from 18 to 24 weeks. Carbon steel tubing deliveries remain mired in their own challenging situation, with allocation stifling the availability of raw material, leaving lead times anywhere from 10 to 18 weeks if strip is available.

Seamless tubing – Current schedules now reflect 8 to 16 weeks for carbon steel and 12 to 18 weeks for stainless. Seamless nickel alloy tubing continues to be hampered by raw material availability as some suppliers have narrowed their quantity of stocked hollows as well as alloys in inventory. As long as hollows are available, anticipate deliveries of seamless nickel tubing in the 14 to 18 week timeframe.

Suffice to say, the metal market is in a tremendous state of uncertainty and price volatility, so please don’t hesitate to reach out if you have any questions.

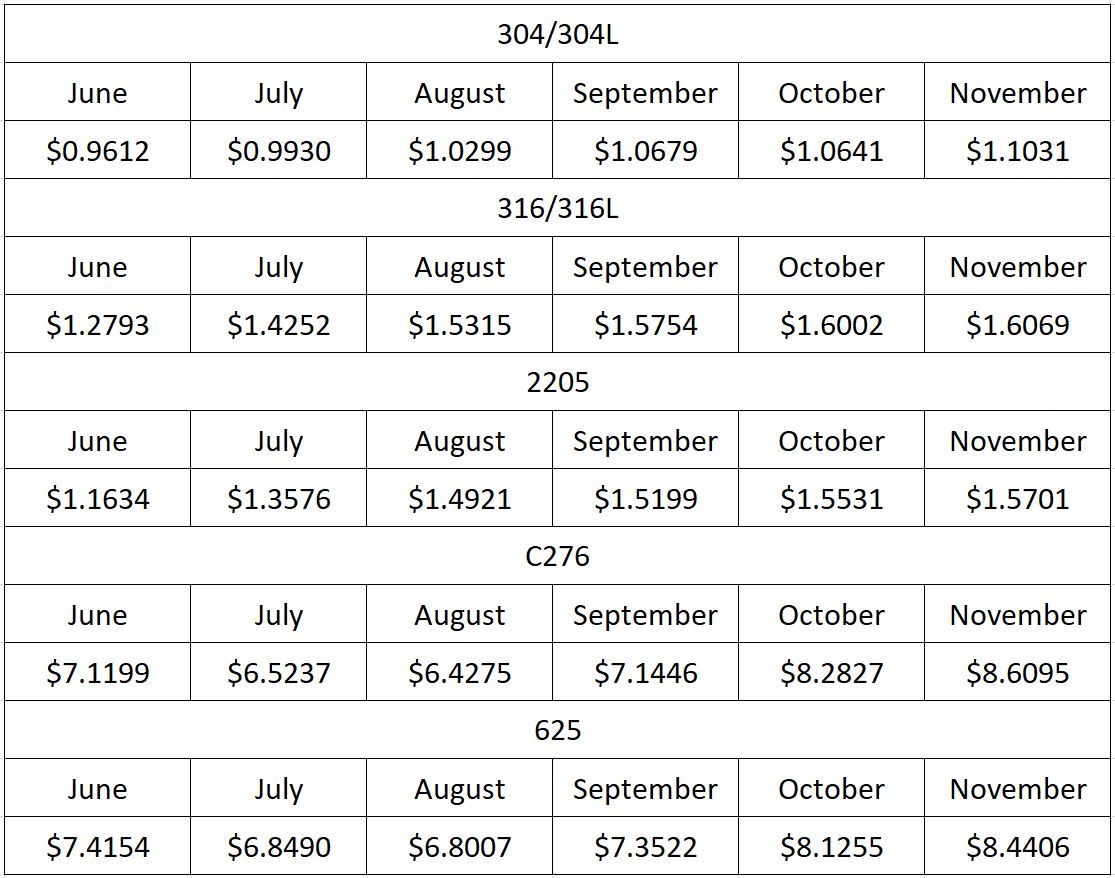

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.