Declining for the second consecutive month, April’s ISM Manufacturing Index (PMI) slid to a 55.4 mark from the 57.1 registered in March. Headwinds presented by persistent labor shortages, instability in energy markets, and increased surcharges contributed to the decline. Even with the supply chain being constrained and price inputs elevated, demand remained strong as a result of the New Order index continuing to show growth.

April’s Consumer Confidence Index marginally declined, registering a 107.3 mark compared to 107.6 in March. While the overall outlook remains positive, continued inflation and the uncertainty posed by the war in Ukraine could dampen consumer spending in the coming months.

WTI Oil traded in a relatively tight band during April, hovering near $100 per barrel all month. It opened at $99.27/barrel, spiked to $108 at mid-month, and ended up closing at $104.69 per barrel. The ongoing fallout from the invasion of Ukraine by Russia should continue to buoy oil prices near the century mark in the short term. Looking further out, if China’s strict COVID lockdown measures persist, weak demand may act as a weight on prices.

The online US Oil Rig Count is at 705 which is up 32 compared to last month’s report and up 257 from May 7 of 2021 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator shows the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

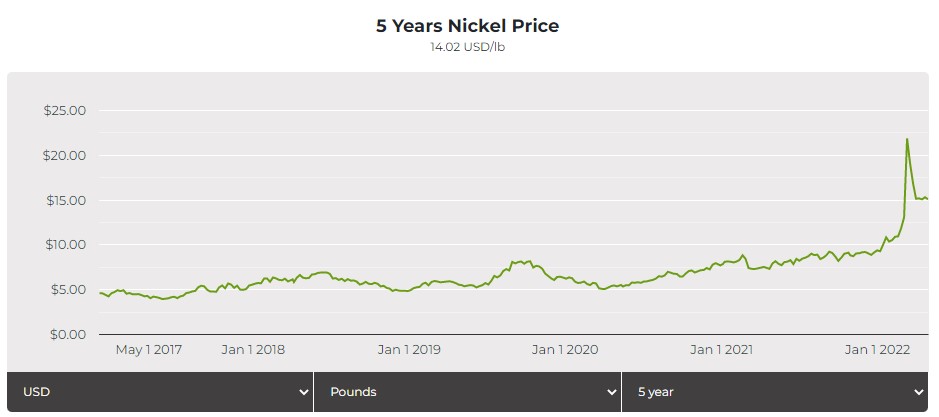

Nickel spent the month of April taking a respite from the recent chaos, starting at $15.07/lb. and closing at $14.54/lb. while averaging close to $15/lb. Competing forces are keeping the price in check seemingly. A strong Dollar and the rumor of excess Nickel production at the mine level are pushing down on the value while the persistent drumbeat of EV adoption and market traders act to prop up the value.

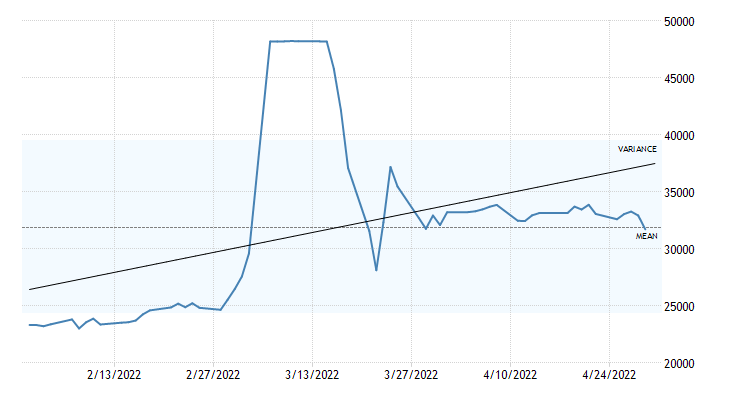

Below is the 90 day Nickel Price Trend (US$ per tonne).

Domestic steel mills announced a $60 per ton price increase in mid-April, continuing to elevate the cost of carbon steel pressure vessel quality plate.

Commodity stainless and Duplex plate deliveries remain in the 8 to 11 week range, while Nickel alloy plates range from 11 to 26 weeks. Carbon Steel plate mill deliveries have settled in the 6 to 12 week delivery range.

Welded tubing –Stainless strip supply has stabilized, allowing for some deliveries in the 10 to 16 week range, with larger quantity orders remaining in the window of 18 to 29 weeks. Carbon steel tubing deliveries have lead times ranging anywhere from 8 to 12 to 20 weeks when strip is available. Welded nickel alloy tubing ranges from 16 to 26 weeks, with some cases of 30 week deliveries.

Seamless tubing – Current schedules reflect 8 to 22 weeks or more for carbon steel (26 to 30 weeks for Western European carbon seamless) and 8 to 30 weeks for stainless. Seamless nickel tubing is being offered at the 10 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 20 to 32 week timeframe.

The metal market is still in a tremendous state of uncertainty and price volatility, so please don’t hesitate to reach out if you have any questions.

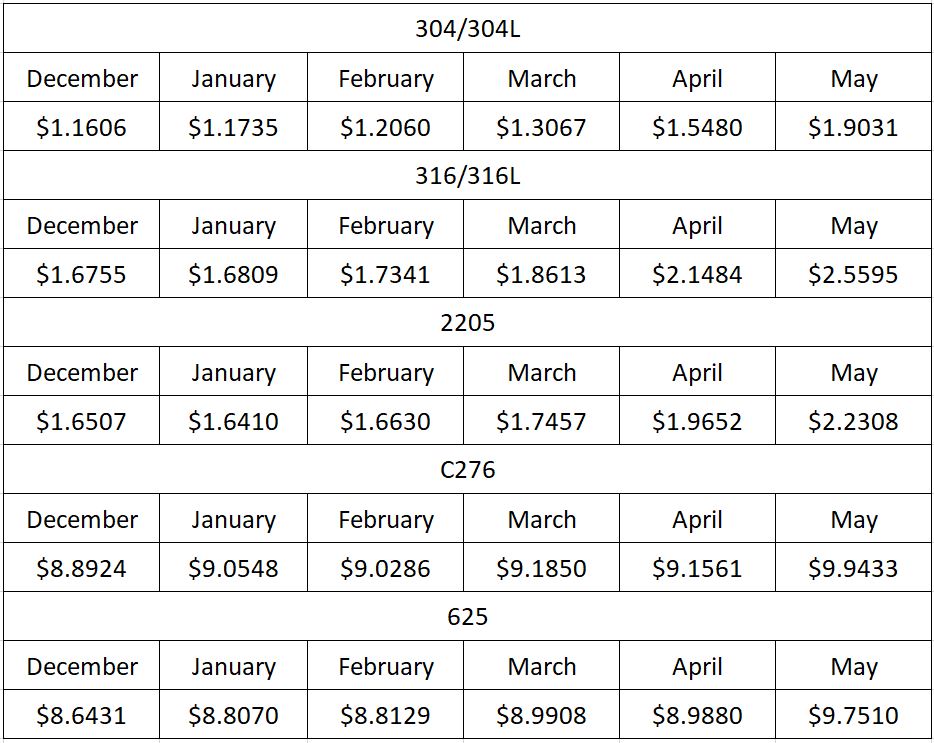

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Industrial Metal Pricing – Change Due War in Ukraine and shutdown of the London Metal Exchange (LME) in Mach of 2022