The March ISM Manufacturing Index (PMI) jumped to a 64.7 reading, the highest level since December of 1983. Besting February’s 60.8 mark, March’s report indicated that 17 of the 18 industries tracked by ISM expanded last month, with most indicating increases in production, new orders, and employment. As a result of the robust manufacturing rebound, many in the industry report shortages of supplies, rising prices, and challenges in finding enough skilled labor.

Boosted by another round of fiscal stimulus and the improving health of the country, Consumer Confidence jumped up to a reading of 109.7 in March (besting February’s 91.3). The general public’s appetite for homes, autos, and other higher priced items has continued unabated. While sentiment is rightfully optimistic, there is some concern that inflation could temper spending in future months.

Spending most of March above the $60 per barrel level, WTI Oil closed the month at $59.16 per barrel at month end after beginning at $60.64. With the Suez Canal open for business again and announced OPEC production increases set to begin in May, conventional wisdom still points to demand slightly outpacing supply, likely pushing oil prices further into the $60 to $70 per barrel range.

The online US Oil Rig count is at 430 which is up 28 compared to last month’s report and down 234 from April 3 of 2020 (high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel). This key and leading indicator shows the current demand for products used in drilling, completing, producing and processing of hydrocarbons which all of us use every day as fuel sources.

March saw Nickel reverse course, beginning at the $8.47/lb. level and then quickly losing over $1.00/lb. during the first week of the month. The balance of the month saw the commodity hover near the $7.40/lb. mark, eventually closing at $7.33/lb. News that Tsingshan would use cheaper nickel matte to supply battery grade nickel for electric vehicles, helped to drive the price downward.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Domestic carbon steel plate mills pushed through a $100/ton price increase in late March. This is the fifth consecutive month that producing mills have implemented a price increase, testing the upward limits of the price spectrum. Carbon steel plate mill deliveries continue to remain in the 8 to 9 week delivery range.

March saw North American Stainless (NAS) push through another $.03/lb. base price increase as demand continues to stay strong. Making things more interesting at month end, the United Steelworkers union went on strike against ATI (Allegheny Technologies). It is uncertain what impact this will have on their stainless and nickel alloy production. For now, domestic stainless mills continue to offer deliveries from 7 to 8 weeks, while Duplex stainless deliveries and Nickel alloy plate deliveries are in the 8 to 10 week range.

Tubing deliveries are uncertain at best in the current environment and here’s a summary of both the welded and seamless product offerings.

Welded tubing – December’s announcement that ATI was beginning to exit the commodity stainless sheet and strip market hamstrung the welded tube market to a degree – taking capacity out of the market and putting more stress on the other two domestic stainless mills (NAS, Outokumpu) to fill the void of supply. Now, the March 30th USW strike against ATI has thrown the supply chain into complete disarray. Allocation and late deliveries of strip have pushed welded stainless tubing deliveries to a range from 12 to 16 weeks or more, depending upon low stock availability, with deliveries of 12 to 18 weeks as the current range for nickel alloys. Carbon steel tubing deliveries are in the midst of their own challenge, with allocation stifling the availability of raw material, pushing lead times anywhere from 9 to 16 weeks.

Seamless tubing – Carbon and stainless tubing continue to enjoy typical delivery schedules (7 weeks for carbon, 6 to 14 weeks for stainless). Seamless nickel alloy tubing looks to be hampered by raw material availability as some suppliers have narrowed their quantity of stocked hollows as well as alloys in inventory. As long as hollows are available, anticipate deliveries of seamless nickel tubing in the 8 to 16 week timeframe.

There is a lot of turmoil in the metal market right now so please don’t hesitate to reach out if you have any questions.

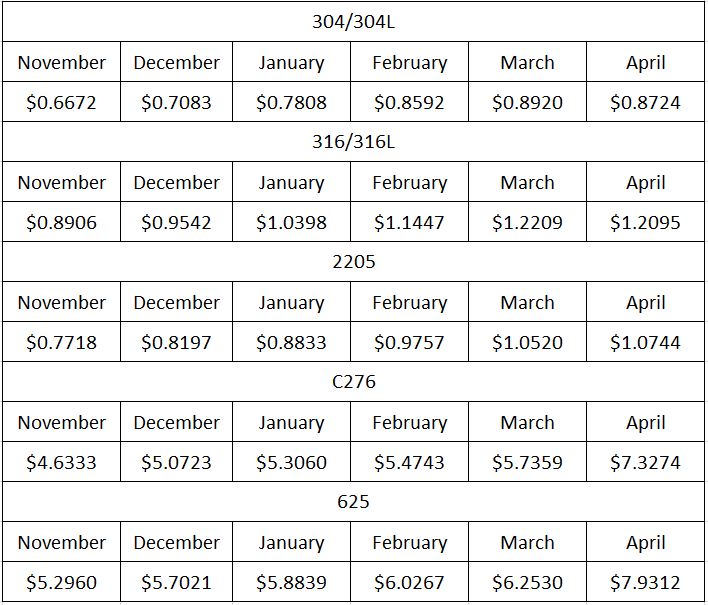

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276 and 625.