The ISM Manufacturing Index (PMI) decreased to 46.3 in March, the lowest since May 2020. This could be implying that the rising interest rates and growing recession fears are starting to weigh on businesses. This is the fifth consecutive month of falling factory activity as companies continue to slow production to better match the demand for the first half of 2023 and prepare for growth in the second half of the year.

The Conference Board Consumer Confidence Index increased to 104.2 in March, up from 103.4 in February. We saw a flipped outlook as to last month with the Present Situation Index, consumers’ assessment of current business and labor market conditions, decreasing by around two points while the Expectations Index, consumers’ short-term outlook for income, business, and labor market conditions, ticked up three points. The Expectations Index has been below 80 for the last 12 out of 13 months, which often signals a recession within the next year. The survey ended ten days after the bank failures, which could have directly affected people’s survey responses.

WTI Oil began March at $77.830 per barrel. Prices peaked at $80.560 per barrel by March 6th. We then experienced a downward slide until March 17th when we saw oil touch $66.930 per barrel, the lowest prices we have seen since early December 2021. Oil began to climb for the remainder of March, closing out at $75.670 per barrel. The upward trend in oil prices has been thought to be in part caused by the surprise production cut of more than 1 million barrels a day by OPEC+. This action complicates the outlook for inflation and interest rates as it was thought that easing price pressures would give central banks room to pause the current tightening cycle. Secondly, an initial agreement has been reached to resume oil exports from the Ceyhan port in Turkey after a dispute involving Kurdish authorities halted around 400,000 barrels a day.

The online US Oil Rig Count is at 755 which is up 6 compared to last month’s report and up 82 from April 1 of 2022 (a high of 1609 in October of 2014 before oil pricing dropped below $20 per barrel at the end of that year). This key and leading indicator show the current demand for products used in drilling, completing, producing, and processing of hydrocarbons which all of us use every day as fuel sources and finished products.

Nickel entered March at $11.192 per pound. By the 22nd, prices had continued to slide to a low of $10.037 per pound, prices we had not seen since the beginning of November 2022. Prices rose to $10.728 per pound by the end of March. These lower prices can be attributed to soaring production, the latest data from the International Nickel Study Group showed a massive 22% year-on-year jump in January driven by the continued increases in Indonesian output. Indonesia grew its output by almost 50% in 2022, accounting for nearly 50% of the global supply of nickel, pushing the market into surplus last year. Concerning demand, investors continue to keep a close eye on the potential for a global recession, the reopening of China, and several processing companies ramping up production.

Below is the 90 day Nickel Price Trend (US$ per tonne).

Molybdenum, a metal mainly used as an alloying agent in stainless steel, has reached highs not seen since 2008. As we entered March, we were welcomed with the first decrease in pricing since the significant jump seen at the start of the New Year. A second decrease of about 16.50% came mid to late March. This has been seen directly affecting the surcharges for materials containing molybdenum as we see welcomed decreases in the most recent release of surcharge pricing.

Commodity stainless and duplex plate deliveries look to have tightened to a 12 to 14 week range, along with Nickel Alloy plates tightening in to 11 to 15 weeks. Carbon steel plate mill deliveries continue to reside in the 6 to 10 week delivery range. Keep in mind some duplex and nickel alloy plates will exceed the estimated ranges depending on the mill’s schedule.

Welded tubing – Currently deliveries for welded stainless tubing has been seen in the 11 to 15 week range, whether small or large quantities. Carbon steel tubing deliveries have lead times ranging anywhere from 8 to 14 weeks when strip is available. Welded nickel alloy tubing ranges from 18 to 24 weeks.

Seamless tubing – Current schedules reflect 10 to 20 weeks or more for carbon steel (24 to 26 weeks for Western European carbon seamless) and 8 to 30 weeks for stainless. Seamless nickel tubing is being offered at the 8 to 12 week delivery window so long as hollows are in stock. If hollows are not readily available, anticipate deliveries of seamless nickel tubing in the 20 to 32 week timeframe.

Please don’t hesitate to reach out if you have any questions about the current state of our industry’s material supply chain.

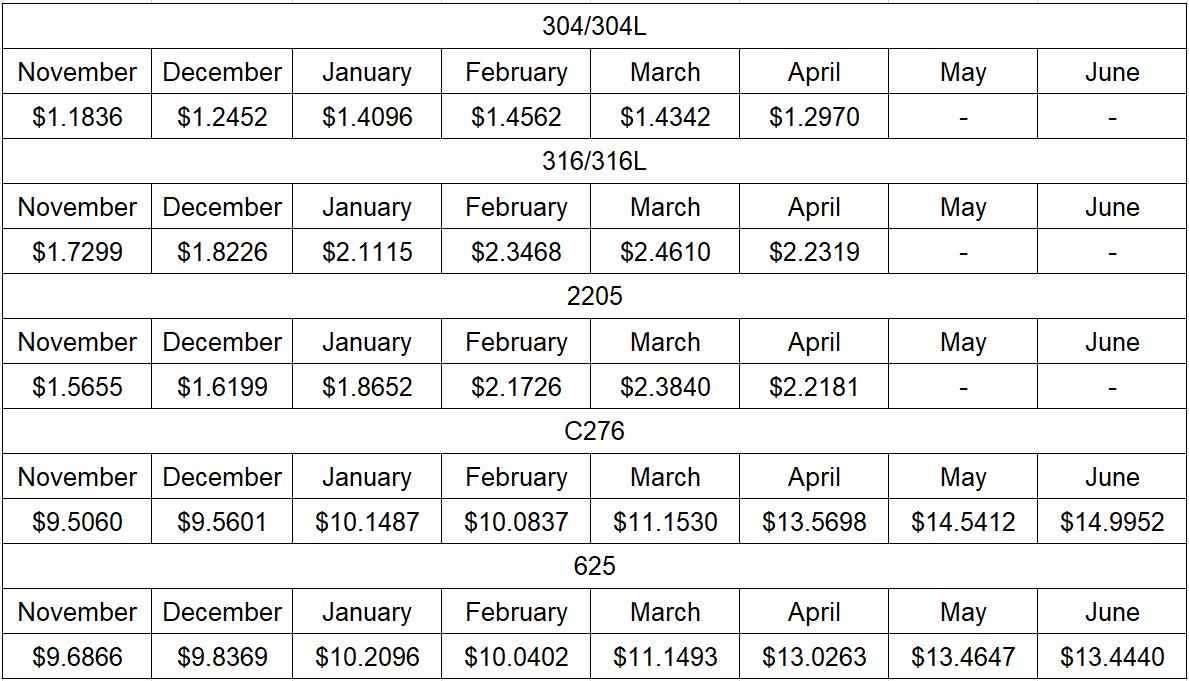

Here’s the current surcharge chart for 304/304LSS, 316/316LSS, 2205, C276, and 625.

Nickel Prices have had an interesting ride over the past two decades with a low of $2.20/lb. in October of 2001 (following September 11 events) and a high of $23.72/lb. in May of 2007. Surcharges trail Nickel prices by approximately two months, so they would have been at their lowest in December of 2001 (304 was $0.0182/lb.) with the peak in July of 2007 (304 was $2.2839/lb.).

The chart below illustrates Nickel price by way of U.S. Dollars per Metric ton.

Here’s the Price Index for Hot Rolled Bars, Plate, and Structural Shapes.